VAR Example Oil#

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

VAR#

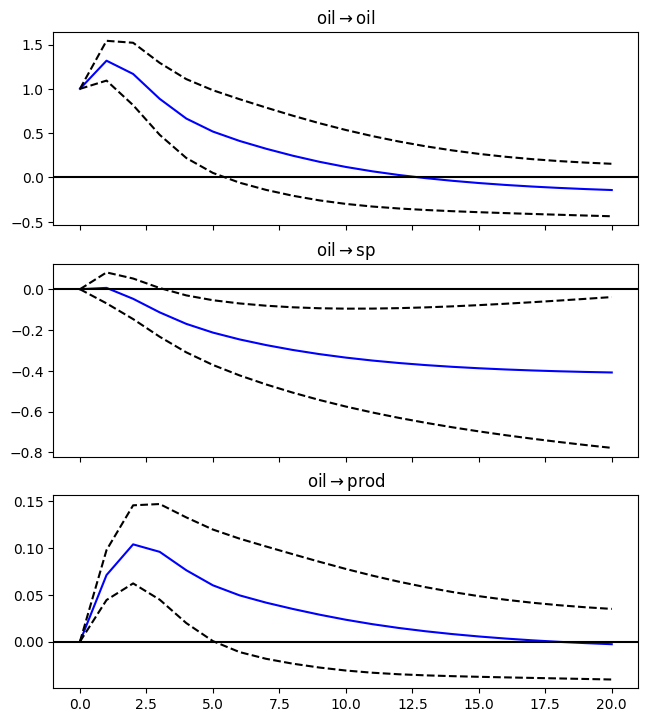

Big oil price increases are often associated with declines in production and asset prices. Read data on the price of crude oil (WTISPLC), industrial production (INDPRO), the S&P 500 (SP500), and the core consumer price index (CPILFESL).

# Libraries

from fredapi import Fred

import pandas as pd

# Setup acccess to FRED

fred_api_key = pd.read_csv('fred_api_key.txt', header=None).iloc[0,0]

fred = Fred(api_key=fred_api_key)

# Series to get

series = ['WTISPLC','INDPRO','SP500','CPILFESL']

rename = ['oil','prod','sp','price']

# Get and append data to list

dl = []

for idx, string in enumerate(series):

var = fred.get_series(string).to_frame(name=rename[idx])

dl.append(var)

print(var.head(2)); print(var.tail(2))

oil

1946-01-01 1.17

1946-02-01 1.17

oil

2025-08-01 64.86

2025-09-01 63.96

prod

1919-01-01 4.8654

1919-02-01 4.6504

prod

2025-07-01 103.8194

2025-08-01 103.9203

sp

2015-10-29 2089.41

2015-10-30 2079.36

sp

2025-10-27 6875.16

2025-10-28 6890.89

price

1957-01-01 28.5

1957-02-01 28.6

price

2025-08-01 329.793

2025-09-01 330.542

# Concatenate data to create data frame (time-series table)

raw = pd.concat(dl, axis=1).sort_index()

# Make all columns numeric

raw = raw.apply(pd.to_numeric, errors='coerce')

# Resample/reindex to quarterly frequency

raw = raw.resample('ME').mean().dropna()

# Display dataframe

display(raw)

| oil | prod | sp | price | |

|---|---|---|---|---|

| 2015-10-31 | 46.22 | 100.1563 | 2084.385000 | 243.768 |

| 2015-11-30 | 42.44 | 99.4366 | 2080.616500 | 244.241 |

| 2015-12-31 | 37.19 | 98.9471 | 2054.079545 | 244.547 |

| 2016-01-31 | 31.68 | 99.4391 | 1918.597895 | 244.955 |

| 2016-02-29 | 30.32 | 98.9232 | 1904.418500 | 245.510 |

| ... | ... | ... | ... | ... |

| 2025-04-30 | 63.54 | 103.6224 | 5369.495714 | 326.430 |

| 2025-05-31 | 62.17 | 103.6570 | 5810.919524 | 326.854 |

| 2025-06-30 | 68.17 | 104.2115 | 6029.951500 | 327.600 |

| 2025-07-31 | 68.39 | 103.8194 | 6296.498182 | 328.656 |

| 2025-08-31 | 64.86 | 103.9203 | 6408.949524 | 329.793 |

119 rows × 4 columns

# Scientific computing

import numpy as np

data = pd.DataFrame()

# log real oil price

data['oil'] = 100*(np.log(raw['oil']/raw['price']))

# log real SP500

data['sp'] = 100*(np.log(raw['sp']/raw['price']))

# log industrial production

data['prod'] = 100*np.log(raw['prod'])

# Sample

sample = data['04-30-2015':'12-31-2024']

display(sample)

| oil | sp | prod | |

|---|---|---|---|

| 2015-10-31 | -166.280435 | 214.601217 | 460.673197 |

| 2015-11-30 | -175.006413 | 214.226408 | 459.952026 |

| 2015-12-31 | -188.336761 | 212.817560 | 459.458536 |

| 2016-01-31 | -204.538895 | 205.827541 | 459.954540 |

| 2016-02-29 | -209.153012 | 204.859431 | 459.434379 |

| ... | ... | ... | ... |

| 2024-08-31 | -142.817683 | 284.071677 | 463.491926 |

| 2024-09-30 | -151.900902 | 286.338423 | 463.079310 |

| 2024-10-31 | -149.705491 | 289.070597 | 462.706670 |

| 2024-11-30 | -152.869136 | 291.129327 | 462.448544 |

| 2024-12-31 | -152.836025 | 292.276288 | 463.516287 |

111 rows × 3 columns

# Johansen Cointegration Test

from statsmodels.tsa.vector_ar.vecm import coint_johansen

test = coint_johansen(sample, det_order=-1, k_ar_diff=2)

test_stats = test.lr1; crit_vals = test.cvt[:, 1]

# Print results

for r_0, (test_stat, crit_val) in enumerate(zip(test_stats, crit_vals)):

print(f'H_0: r <= {r_0}')

print(f' Test Stat. = {test_stat:.2f}, 5% Crit. Value = {crit_val:.2f}')

if test_stat > crit_val:

print(' => Reject null hypothesis.')

else:

print(' => Fail to reject null hypothesis.')

H_0: r <= 0

Test Stat. = 20.88, 5% Crit. Value = 24.28

=> Fail to reject null hypothesis.

H_0: r <= 1

Test Stat. = 3.35, 5% Crit. Value = 12.32

=> Fail to reject null hypothesis.

H_0: r <= 2

Test Stat. = 0.19, 5% Crit. Value = 4.13

=> Fail to reject null hypothesis.

# Select number of lags in VECM

from statsmodels.tsa.vector_ar.vecm import select_order

lag_order_results = select_order(

sample, maxlags=8, deterministic='co')

print(f'Selected lag order (AIC) = {lag_order_results.aic}')

Selected lag order (AIC) = 1

# VAR model

from statsmodels.tsa.api import VAR

# make the VAR model

model = VAR(sample)

# Estimate VAR

results = model.fit(2)

# Assign impulse response functions (IRFs)

irf = results.irf(20)

# Plot IRFs

plt = irf.plot(orth=False,impulse='oil',figsize=(6.5,7.5));

plt.suptitle('');