RBC Model#

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Slides

Summary#

Introduce a nonlinear theoretical model of business cycles.

Get the equilibrium conditions and linear the system of equations.

Solve the linear system, i.e., express (observable) endogenous variables as functions of (hidden) state variables.

Estimate the state vector with the Kalman filter.

The following example is a simplified exposition of Chad Fulton’s RBC example in Python here: https://www.chadfulton.com/topics/estimating_rbc.html

The Model#

A social planner chooses how much to consume, work, and invest, \(\{c_{t+j},n_{t+j},i_{t+j}\}_{j=0}^\infty\), to maximize present value lifetime utility

\[ E_t \sum_{j=0}^\infty \beta^j [\log(c_{t+j}) - \psi n_{t+j}] \]subject to:

resource constraint: \(y_t = c_t+i_t\)

capital accumulation: \(k_t = (1−\delta)k_{t-1}+i_t\)

production function: \(y_t = z_t k_{t-1}^\alpha n_t^{1 - \alpha}\)

Total factor productivity (TFP):

\(\log z_t = (1-\rho)\bar{z} + \rho \log z_{t-1} + \eta_t\) where \(\eta_t \sim N(0, \sigma^2)\)

\(E_t\) is an expectation operator conditional data through time \(t\), i.e., it’s a forecast because TFP is random/stochastic

Parameters#

This model has the following parameters

Parameter |

Description |

Parameter |

Description |

|---|---|---|---|

\(\beta\) |

Discount factor |

\(\rho\) |

TFP shock persistence |

\(\psi\) |

Marginal disutility of work |

\(\sigma^2\) |

TFP shock variance |

\(\delta\) |

Capital depreciation rate |

\(\alpha\) |

Capital-share of output |

Example parameterization

Parameter |

Value |

Parameter |

Value |

|---|---|---|---|

\(\beta = \) |

0.95 |

\(\rho = \) |

0.85 |

\(\psi = \) |

3 |

\(\sigma^2 = \) |

0.04 |

\(\delta = \) |

0.025 |

\(\alpha = \) |

0.36 |

The ultimate goal is to estimate (some of) these parameters.

Equilibrium#

The RBC model is a constrained optimization problem which can be written as a Lagrangian with the following first order conditions (i.e., equilibrium conditions).

In equilibrium, the marginal benefit (i.e., utility) of a unit of consumption today equals the marginal cost (i.e., lost future utility) forgoing the future return on a unit of investment:

\[ \frac{1}{c_t} = E_t \left \{\beta \frac{1}{c_{t+1}} \left [ r_{t+1} + (1 - \delta) \right ] \right \} \]where \(1/c_t\) is the marginal utility of consumption and \(r_t = \alpha y_t/k_{t-1}\) is the marginal product of capital.

In equilibrium, the marginal benefit (i.e., utility) of work equals the marginal cost (i.e., disutility) of work.

\[ \psi = \frac{1}{c_t} w_t \]where \(w_t = (1 - \alpha) y_t/n_t\) is the marginal product of work.

Including the constraints completes the nonlinear equilibrium system.

Linear System#

The linearized equilibrium system of equations is

\[\begin{gather*} - \gamma \hat{c}_t = - \gamma E_t\hat{c}_{t+1} + \beta rE_t\hat{r}_{t+1} \\ \hat{r}_t = \hat{y}_t-\hat{k}_{t-1}\\ \hat{c}_t = \hat{w}_t \\ \hat{w}_t = \hat{y}_t - \hat{n}_t\\ y \hat{y}_t = c\hat{c}_t + i\hat{i}_t \\ k\hat{k}_t = (1-\delta)k\hat{k}_{t-1} + i\hat{i}_t \\ \hat{y}_t = \hat{z}_t + \alpha\hat{k}_{t-1}+(1-\alpha)\hat{n}_t\\ \hat{z}_t = \rho \hat{z}_{t-1} + \sigma \eta_t \end{gather*}\]The state variables for this system are \((k_{t-1}, z_{t-1})\), i.e., the social planner needs to know those to make decisions at \(t\).

There are 8 variables, \(\{c,r,y,k,w,n,i,z\}\), which (importantly!) equals the number of equations.

This is a linear model with (rational) expectations/forecasts, i.e., the social planner forecasts with full understanding of the structure of the model, the initial conditions/state, \((k_{t-1}, z_{t-1})\), and the distribution of TFP.

A solution to the model expresses the endogenous variables \((y_t, c_t, i_t, n_t)\) as functions of the state variables \((k_{t-1}, z_{t-1})\).

We can obtain the solution with methods in Blanchard-Kahn (1980) or Chris Sims’ gensys.

The solution to the linear system is represented in state-space form.

Solution#

Observation equation(s):

State equation(s):

Given the above parameterization, the solution is

Parameter |

Value |

|---|---|

\(\phi_{ck}\) |

0.534 |

\(\phi_{cz}\) |

0.487 |

\(T_{kk}\) |

0.884 |

\(T_{kz}\) |

0.319 |

\(\alpha\) |

0.36 |

Business Cycle Data#

In the RBC model, \(\hat{x}_t \equiv 100\times(x_t/\bar{x} -1)\) where \(\bar{x}\) is the (constant) long-run equilibrium.

Q: What is the equivalent object in time series data with stochastic or time trends?

The Hodrick-Prescott (HP) filter is one (of many) mathematical tool(s) used to decompose a time series \(x_t\) into:

\(\tau_t\): A smooth trend component capturing both time and stochastic trends

\(c_t\): A cyclical component, i.e., the object of interest for business cycle economists

In other words, we can express the data as percent changes from a “long run equilbrium”, \(\hat{x}_t = 100(x_t/\tau_t - 1)\), i.e., percent deviations from trend.

In business cycle research, other popular choices are the band-pass filter and Hamilton filter.

James Hamilton wrote a critque of the HP filter, and then created “a better alternative,” which now has over 2000 citations as of Spring 2025.

The HP filter finds the trend \(\tau_t\) by solving a minimization problem:

\[ \min_{\tau_t} \sum_{t=1}^T (y_t - \tau_t)^2 + \lambda \sum_{t=2}^{T-1} \left[(\tau_{t+1} - \tau_t) - (\tau_t - \tau_{t-1})\right]^2 \]First term: \((y_t - \tau_t)^2\) makes the trend close to the actual data.

Second term: \(\left[(\tau_{t+1} - \tau_t) - (\tau_t - \tau_{t-1})\right]^2\) penalizes sharp changes in the slope of the trend, enforcing smoothness.

\(\lambda\) influences the smoothness of the resulting trend

Small \(\lambda\) → Trend follows the data closely (e.g., wiggly trend with “sharp” changes).

Large \(\lambda\) → Trend is very smooth (e.g., nearly a straight line).

Common Choices for \(\lambda\)

\(\lambda = 1600\) for quarterly data

\(\lambda = 14400\) for monthly data

\(\lambda = 100\) for annual data

Reading Data#

# Libraries

from fredapi import Fred

import pandas as pd

# Setup acccess to FRED

fred_api_key = pd.read_csv('fred_api_key.txt', header=None).iloc[0,0]

fred = Fred(api_key=fred_api_key)

# Series to get

series = ['GDP','PRS85006023','PCE','GDPDEF','USREC']

rename = ['gdp','hours','cons','price','rec']

# Get and append data to list

dl = []

for idx, string in enumerate(series):

var = fred.get_series(string).to_frame(name=rename[idx])

dl.append(var)

print(var.head(2)); print(var.tail(2))

gdp

1946-01-01 NaN

1946-04-01 NaN

gdp

2025-01-01 30042.113

2025-04-01 30485.729

hours

1947-01-01 117.931

1947-04-01 117.425

hours

2025-01-01 97.895

2025-04-01 98.038

cons

1959-01-01 306.1

1959-02-01 309.6

cons

2025-07-01 20982.7

2025-08-01 21111.9

price

1947-01-01 11.141

1947-04-01 11.299

price

2025-01-01 127.577

2025-04-01 128.248

rec

1854-12-01 1.0

1855-01-01 0.0

rec

2025-08-01 0.0

2025-09-01 0.0

# Concatenate data to create data frame (time-series table)

rawm = pd.concat(dl, axis=1).sort_index()

# Resample/reindex to quarterly frequency

raw = rawm.resample('QE').last().dropna()

# real GDP

raw['rgdp'] = raw['gdp']/raw['price']

# real Consumption

raw['rcons'] = raw['cons']/raw['price']

# Display dataframe

display(raw)

| gdp | hours | cons | price | rec | rgdp | rcons | |

|---|---|---|---|---|---|---|---|

| 1959-03-31 | 510.330 | 114.850 | 312.7 | 15.224 | 0.0 | 33.521414 | 20.539937 |

| 1959-06-30 | 522.653 | 115.194 | 318.2 | 15.248 | 0.0 | 34.276823 | 20.868311 |

| 1959-09-30 | 525.034 | 114.834 | 324.2 | 15.307 | 0.0 | 34.300255 | 21.179852 |

| 1959-12-31 | 528.600 | 114.570 | 322.9 | 15.367 | 0.0 | 34.398386 | 21.012559 |

| 1960-03-31 | 542.648 | 114.326 | 330.2 | 15.428 | 0.0 | 35.172932 | 21.402645 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-06-30 | 29147.044 | 97.869 | 19844.5 | 125.167 | 0.0 | 232.865244 | 158.544185 |

| 2024-09-30 | 29511.664 | 97.803 | 20147.6 | 125.696 | 0.0 | 234.786023 | 160.288315 |

| 2024-12-31 | 29825.182 | 97.923 | 20514.3 | 126.450 | 0.0 | 235.865417 | 162.232503 |

| 2025-03-31 | 30042.113 | 97.895 | 20683.0 | 127.577 | 0.0 | 235.482203 | 162.121699 |

| 2025-06-30 | 30485.729 | 98.038 | 20868.4 | 128.248 | 0.0 | 237.709196 | 162.719107 |

266 rows × 7 columns

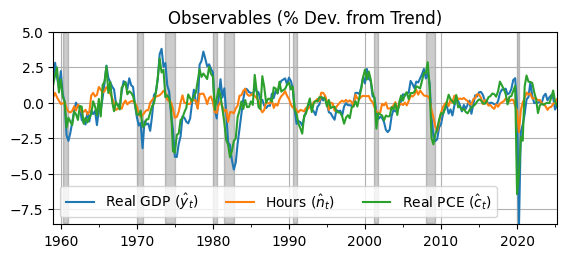

HP Filter#

The vector of observable endogenous variables is \([\hat y_t, \hat n_t, \hat c_t]\), where \(\hat{x}_t = 100(x_t/\tau_t - 1)\) and \(\tau_t\) is the smooth trend from the HP filter.

# Hodrick-Prescott filter

from statsmodels.tsa.filters.hp_filter import hpfilter

# Smothing parameter for quarterly data

lam = 1600

# Raw data to detrend

vars = ['rgdp','hours','rcons']

nvar = len(vars)

# Detrend raw data

data = pd.DataFrame()

for var in vars:

cycle, trend = hpfilter(raw[var],lam)

data[var] = 100*(raw[var]/trend - 1)

/opt/hostedtoolcache/Python/3.12.7/x64/lib/python3.12/site-packages/statsmodels/tsa/filters/hp_filter.py:100: SparseEfficiencyWarning: spsolve requires A be CSC or CSR matrix format

trend = spsolve(I+lamb*K.T.dot(K), x, use_umfpack=use_umfpack)

/opt/hostedtoolcache/Python/3.12.7/x64/lib/python3.12/site-packages/statsmodels/tsa/filters/hp_filter.py:100: SparseEfficiencyWarning: spsolve requires A be CSC or CSR matrix format

trend = spsolve(I+lamb*K.T.dot(K), x, use_umfpack=use_umfpack)

/opt/hostedtoolcache/Python/3.12.7/x64/lib/python3.12/site-packages/statsmodels/tsa/filters/hp_filter.py:100: SparseEfficiencyWarning: spsolve requires A be CSC or CSR matrix format

trend = spsolve(I+lamb*K.T.dot(K), x, use_umfpack=use_umfpack)

ax = data.plot(); ax.grid(); ax.set_title('Observables (% Dev. from Trend)')

ax.legend([r'Real GDP ($\hat y_t$)',r'Hours ($\hat n_t$)',r'Real PCE ($\hat c_t$)'],ncol=3);

fig = ax.get_figure(); fig.set_size_inches(6.5,2.5)

# Shade NBER recessions

usrec = rawm['3/31/1959':'12/31/2024']['rec']

ax.fill_between(usrec.index, -8.5, 5, where=usrec.values, color='k', alpha=0.2)

ax.autoscale(tight=True)

RBC Model in Python#

Set the parameters in the state space model, which represents the solution to the linearized RBC model.

# Define the state space model

# Parameters

phick = 0.534; phicz = 0.487

Tkk = 0.884; Tkz = 0.319

alpha = 0.36; rho = 0.85; sigma2 = 0.4;

Simplified Observation (Measurement) Equation: \(\mathbf{y}_t = \mathbf{\mathbf{Z}} \mathbf{x}_t + \boldsymbol{\boldsymbol{\varepsilon}}_t\) where \(\boldsymbol{\varepsilon}_t \sim N(0, \mathbf{H})\)

# Scientific computing

import numpy as np

# Observation equation

Z11 = 1 - (1-alpha)*phick/alpha

Z12 = 1/alpha - (1-alpha)*phicz/alpha

Z21 = 1 - phick/alpha

Z22 = (1-phicz)/alpha

Z31 = phick

Z32 = phicz

Z = np.array([[Z11,Z12],[Z21,Z22],[Z31,Z32]])

H = 1e-8*np.eye(nvar)

display(Z)

display(H)

array([[ 0.05066667, 1.912 ],

[-0.48333333, 1.425 ],

[ 0.534 , 0.487 ]])

array([[1.e-08, 0.e+00, 0.e+00],

[0.e+00, 1.e-08, 0.e+00],

[0.e+00, 0.e+00, 1.e-08]])

Simplified State (Transition) Equation: \(\mathbf{x}_t = \mathbf{F} \mathbf{x}_{t-1} + \boldsymbol{\boldsymbol{\eta}}_t\) where \(\boldsymbol{\eta}_t \sim N(0, \mathbf{Q})\)

# Transition equation

F = [[Tkk,Tkz],[0,rho]]

Q = [[0,0],[0,sigma2]]

display(F)

display(Q)

[[0.884, 0.319], [0, 0.85]]

[[0, 0], [0, 0.4]]

Kalman Filter#

from statsmodels.tsa.statespace.kalman_filter import KalmanFilter

# Initialize the Kalman filter

kf = KalmanFilter(k_endog=nvar, k_states=2)

kf.design = Z

kf.obs_cov = H

kf.transition = F

kf.state_cov = Q

# Initial state vector mean and covariance

kf.initialize_known(constant=np.zeros(2), stationary_cov=Q)

# Extract data from Dataframe as NumPy array

observations = np.array(data)

# Convert data to match the required type

observations = np.asarray(observations, order="C", dtype=np.float64)

# Bind the data to the KalmanFilter object

kf.bind(observations)

# Extract filtered state estimates

res = kf.filter()

filtered_state_means = res.filtered_state

filtered_state_covariances = res.filtered_state_cov

display(filtered_state_means.shape)

display(filtered_state_covariances.shape)

(2, 266)

(2, 2, 266)

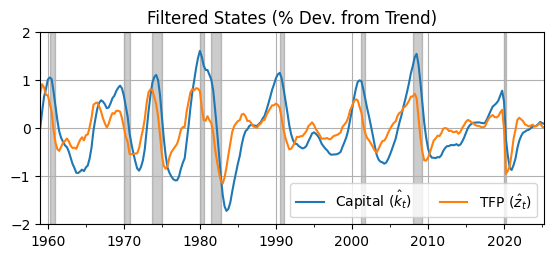

Filtered (Estimated) States#

xhat = pd.DataFrame(filtered_state_means.T,index=data.index)

ax = xhat.plot(); ax.grid(); ax.set_title('Filtered States (% Dev. from Trend)')

fig = ax.get_figure(); fig.set_size_inches(6.5,2.5)

ax.legend([r'Capital ($\hat k_t$)',r'TFP ($\hat z_t$)'],ncol=2);

# Shade NBER recessions

ax.fill_between(usrec.index, -2, 2, where=usrec.values, color='k', alpha=0.2)

ax.autoscale(tight=True)

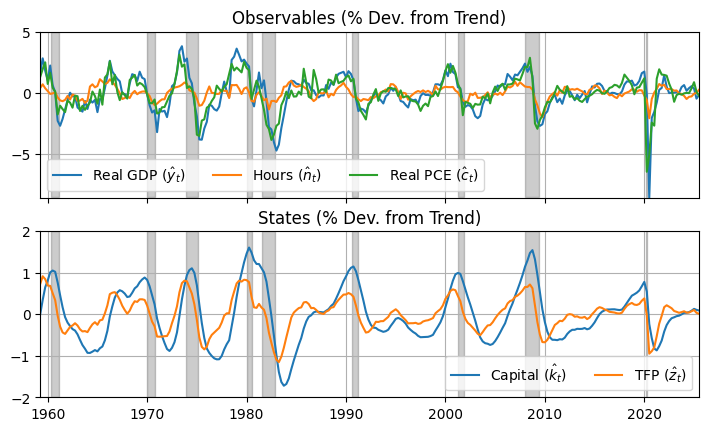

import matplotlib.pyplot as plt

fig, axs = plt.subplots(2,figsize=(6.5,4)); fig.set_size_inches(8.5,4.75)

axs[0].plot(data); axs[0].grid(); axs[0].set_title('Observables (% Dev. from Trend)')

axs[0].legend([r'Real GDP ($\hat y_t$)',r'Hours ($\hat n_t$)',r'Real PCE ($\hat c_t$)'],ncol=3);

axs[0].fill_between(usrec.index, -8.5, 5, where=usrec.values, color='k', alpha=0.2)

axs[1].plot(xhat); axs[1].grid(); axs[1].set_title('States (% Dev. from Trend)')

axs[1].legend([r'Capital ($\hat k_t$)',r'TFP ($\hat z_t$)'],ncol=2);

axs[1].fill_between(usrec.index, -2, 2, where=usrec.values, color='k', alpha=0.2)

axs[0].label_outer(); axs[0].autoscale(tight=True); axs[1].autoscale(tight=True)

Parameter Estimation#

loglike = res.llf

print(f"Log-likelihood: {loglike}")

Log-likelihood: -35903447159.552734

Kalman filter produces log likelihood for this parameterization

We could do a better job calibrating some parameters like the discount factor (\(\beta\)) and the labor preference parameter (\(\psi\))

Then we could search the parameter space for TFP process parameters, \(\{\rho,\sigma^2\}\), that maximize the log likelihood.

This model is very simple.

We could change the utility function to add a risk aversion parameter.

We could add investment adjustment costs and variable capital utilization.

We could add demand shocks from government spending or monetary policy.