Review 1B Key#

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Slides

1)#

Read U.S. Industrial Production: Total Index (

IPB50001N) from FRED.Resample/reindex the data to a quarterly frequency using the value for the last month of each quarter.

Print the original data and compare it to the resampled/reindexed data to verify it is correct.

# Libraries

from fredapi import Fred

import pandas as pd

# Read data

fred_api_key = pd.read_csv('fred_api_key.txt', header=None)

fred = Fred(api_key=fred_api_key.iloc[0,0])

data = fred.get_series('IPB50001N').to_frame(name='IP')

print(data.tail(3))

# Resample/reindex to quarterly frequency

data = data.resample('QE').last()

# Print data

print(f'number of rows/quarters = {len(data)}')

print(data.tail(3))

IP

2025-06-01 105.4026

2025-07-01 104.3398

2025-08-01 106.0004

number of rows/quarters = 427

IP

2025-03-31 104.1248

2025-06-30 105.4026

2025-09-30 106.0004

2)#

Why is this data not stationary?

Use appropriate transformations to remove the non-stationarity and plot the series.

Correctly and completely label the plot.

# Plotting

import matplotlib.pyplot as plt

# Plot

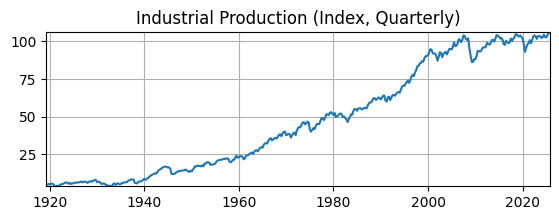

fig, ax = plt.subplots(figsize=(6.5,2));

ax.plot(data.IP);

ax.set_title('Industrial Production (Index, Quarterly)');

ax.grid(); ax.autoscale(tight=True)

This data is non-stationary because it is seasonal over the year and it has an exponential time trend.

# Scientific computing

import numpy as np

# Transform data

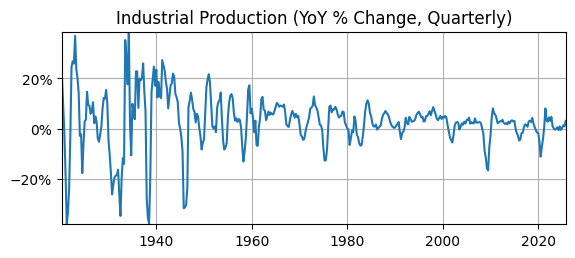

# Take log

data['logIP'] = np.log(data.IP)

# Take difference

data['dlogIP'] = 100*(data.logIP.diff(4))

# Plot

fig, ax = plt.subplots(figsize=(6.5,2.5));

ax.plot(data.dlogIP);

ax.set_title('Industrial Production (YoY % Change, Quarterly)');

ax.yaxis.set_major_formatter('{x:.0f}%')

ax.grid(); ax.autoscale(tight=True)

Time varying volatility indicates this is non-stationary data.

3)#

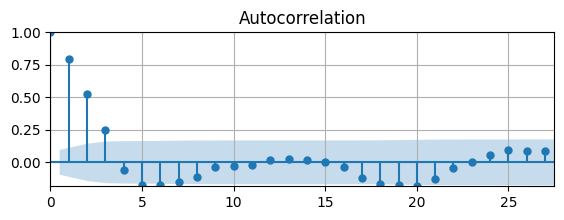

Plot the autocorrelation function of the transformed data.

Is it stationary? Why or why not?

# Auto-correlation function

from statsmodels.graphics.tsaplots import plot_acf as acf

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,2))

acf(data.dlogIP.dropna(),ax)

ax.grid(); ax.autoscale(tight=True)

ACF is signifcant at long lags, doesn’t clearly taper to zero

might be non-stationary

First 3 lags are remarkable

4)#

Conduct a unit root test of the transformed data.

Is it stationary? Why or why not?

# ADF Test

from statsmodels.tsa.stattools import adfuller

# Function to organize ADF test results

def adf_test(data):

keys = ['Test Statistic','p-value','# of Lags','# of Obs']

values = adfuller(data)

test = pd.DataFrame.from_dict(dict(zip(keys,values[0:4])),

orient='index',columns=[data.name])

return test

adf_test(data.dlogIP.dropna())

| dlogIP | |

|---|---|

| Test Statistic | -5.814992e+00 |

| p-value | 4.313232e-07 |

| # of Lags | 1.500000e+01 |

| # of Obs | 4.070000e+02 |

Null hypothesis: data has unit root

p-value near zero, so reject the null

Unit root test says data is probably stationary

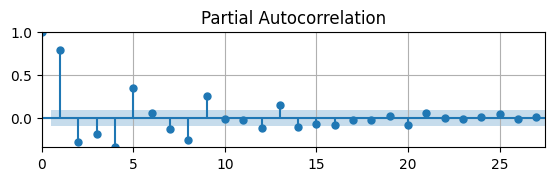

5)#

If you were to pick a parsimonious AR model (i.e., the number of lags is less than 5) to fit the transformed data, what lag would you pick? Why?

# Partial auto-correlation function

from statsmodels.graphics.tsaplots import plot_pacf as pacf

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

pacf(data.dlogIP.dropna(),ax)

ax.grid(); ax.autoscale(tight=True);

PACF is signficantly different from zero for first 5 lags

Stops being signficant for lag 6

6)#

Given your last answer, estimate an AR model given the transformed quarterly data.

Interpret the results.

# ARIMA model

from statsmodels.tsa.arima.model import ARIMA

# Define model

mod = ARIMA(data.dlogIP,order=(5,0,0))

# Estimate model

res = mod.fit()

summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

#print(tab0); print(tab1); print(tab2)

| Dep. Variable: | dlogIP | No. Observations: | 425 |

|---|---|---|---|

| Model: | ARIMA(5, 0, 0) | Log Likelihood | -1298.814 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 2.9265 | 0.975 | 3.002 | 0.003 | 1.016 | 4.837 |

| ar.L1 | 1.0243 | 0.031 | 32.647 | 0.000 | 0.963 | 1.086 |

| ar.L2 | -0.1735 | 0.042 | -4.163 | 0.000 | -0.255 | -0.092 |

| ar.L3 | 0.1902 | 0.035 | 5.505 | 0.000 | 0.123 | 0.258 |

| ar.L4 | -0.6642 | 0.029 | -22.871 | 0.000 | -0.721 | -0.607 |

| ar.L5 | 0.3486 | 0.025 | 13.773 | 0.000 | 0.299 | 0.398 |

| sigma2 | 27.8385 | 0.912 | 30.511 | 0.000 | 26.050 | 29.627 |

| Heteroskedasticity (H): | 0.05 | Skew: | 0.34 |

|---|---|---|---|

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 13.72 |

All the AR coefficients are significantly different than zero

Residuals have a lot of kurtosis, so maybe AR model isn’t the best choice