Mixed-Frequency Data#

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Slides

Summary#

In the Data in Python Notebook, we read one time series, Real GDP, from FRED.

This Jupyter Notebook will demonstrate how to use a

forloop to read and plot multiple time series in Python.These time series will have mixed frequencies, e.g., daily, monthly, quarterly, annual.

Reading data#

Let’s create a Data Frame with three columns, a

DATEindex,RGDP(Real GDP), andPCEPI(Personal Consumption Expenditures Price Index).Our goal is to plot the Real GDP Growth Rate and an inflation rate based on

PCEPI, which is a measure of the average price of consumption goods in the U.S.We can create a Data Frame and assign the columns/variables using a for loop. This is especially useful if you have data from different sources (i.e., FRED and some other sources).

# Libraries

from fredapi import Fred

import pandas as pd

# Setup acccess to FRED

fred_api_key = pd.read_csv('fred_api_key.txt', header=None)

fred = Fred(api_key=fred_api_key.iloc[0,0])

# Series to get

series = ['GDPC1','PCEPI']

# Get and append data to list

dl = []

for _, string in enumerate(series):

var = fred.get_series(string).to_frame(name=string)

dl.append(var)

print(var.head(2)); print(var.tail(2))

GDPC1

1947-01-01 2182.681

1947-04-01 2176.892

GDPC1

2025-01-01 23548.210

2025-04-01 23770.976

PCEPI

1959-01-01 15.164

1959-02-01 15.179

PCEPI

2025-07-01 126.949

2025-08-01 127.285

for _, string in enumerate(series):is a for loop that assigns a string,string, to each element ofseries.dlis a list with the data, notice the variables do not share the same datetime index, one is quarterly and the other is monthly, i.e., the data has mixed frequency. Furthermore, the first and last date of each variable is different.

# Concatenate data to create data frame (time-series table)

df = pd.concat(dl, axis=1).sort_index()

df.columns = ['RGDP','PCEPI']

# Display data

print(f'len(df) = {len(df)}')

print(df.head(4))

print(df.tail(4))

len(df) = 848

RGDP PCEPI

1947-01-01 2182.681 NaN

1947-04-01 2176.892 NaN

1947-07-01 2172.432 NaN

1947-10-01 2206.452 NaN

RGDP PCEPI

2025-05-01 NaN 126.380

2025-06-01 NaN 126.743

2025-07-01 NaN 126.949

2025-08-01 NaN 127.285

pd.concatcreates a data frame (time-series table),df, with a common datetime index but with mixed-frequency data, i.e.,RGDPhas values every quarter andPCEPIhas values every month and any missing values are filled in withNaN(i.e., Not a Number)

# Resample/reindex to quarterly frequency

df = df.resample('QE').last()

# Display data

print(f'len(df) = {len(df)}')

print(df.head(2))

print(df.tail(2))

len(df) = 315

RGDP PCEPI

1947-03-31 2182.681 NaN

1947-06-30 2176.892 NaN

RGDP PCEPI

2025-06-30 23770.976 126.743

2025-09-30 NaN 127.285

dfhad mix-frequency data. The pandas methodsresampleresamples the data frame to a desired common frequency, which is usually the lowest frequency of all the variables. That is a quarterly frequency here.resample('QE-DEC').last()resamples all variables to a quarterly frequency using the last value in each quarterly interval, and it reindexes the entire DataFrame such that each value corrresponds to the last day of the quarter (and is now standard practice inpandas, in contrast to FRED where each quarterly value was assigned to the first day).dfnow contains fewer rows, one for each quarter. The variablePCEPIis stillNaNat the beginning of the sample, andRGDPis missing a value for the end of the sample.

# Import libraries

import numpy as np

# Real GDP Growth Rate (percent change)

df['logRGDP'] = np.log(df.RGDP)

df['growth_rate'] = 100*(df.logRGDP - df.logRGDP.shift(4))

# PCE inflation rate (percent change)

df['logPCEPI'] = np.log(df.PCEPI)

df['inf_rate'] = 100*(df.logPCEPI - df.logPCEPI.shift(4))

# Display data

pd.options.display.float_format = '{:,.2f}'.format

print(df.tail(4))

# Latest Real GDP value

print()

print(f'2024Q3 real GDP Year over Year Growth Rate = \

{df.growth_rate['2024-09-30']:.2f}%')

RGDP PCEPI logRGDP growth_rate logPCEPI inf_rate

2024-12-31 23,586.54 124.98 10.07 2.37 4.83 2.69

2025-03-31 23,548.21 125.94 10.07 2.00 4.84 2.33

2025-06-30 23,770.98 126.74 10.08 2.06 4.84 2.56

2025-09-30 NaN 127.28 NaN NaN 4.85 2.48

2024Q3 real GDP Year over Year Growth Rate = 2.75%

# Import libraries

import matplotlib.pyplot as plt

# Plot options

# Sub sample

date_start = '01-01-1960'

date_end = '12-31-2023'

# Variables to plot

# Variable Plot title

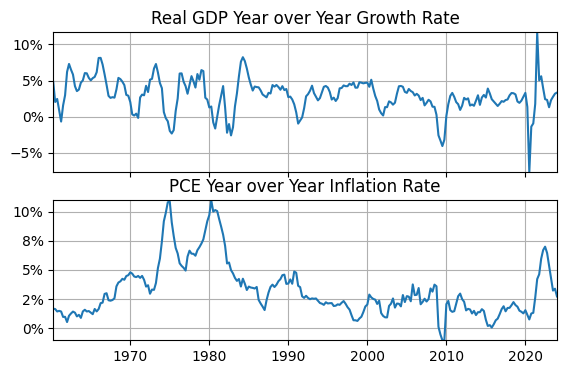

plotme = [

['growth_rate', 'Real GDP Year over Year Growth Rate'],

['inf_rate', 'PCE Year over Year Inflation Rate']]

# Plot variables

fig, axs = plt.subplots(len(plotme),figsize=(6.5,4))

for idx, ax in enumerate(axs.flat):

ax.plot(df[plotme[idx][0]][date_start:date_end])

ax.set_title(plotme[idx][1])

ax.yaxis.set_major_formatter('{x:.0f}%')

ax.grid(); ax.autoscale(tight=True); ax.label_outer()

plt.subplots(len(vars))creates a figure with 2 subplotsfor idx, ax in enumerate(axs.flat):is a for loop that assigns an integer index,idx, and axis handle,ax, to each element ofaxs.flatthat indicate the subplot being formatted and where the data is plotted.ax.label_outer()skips the year label on the first plot and only shows it on the second axis.

Conclusion#

We used a for loop to assign multiple time series to a pandas DataFrame. Then we resampled the variables in the DataFrame to a common lower frequency. Based on those values, we calculated year-over-year real GDP growth and PCE inflation rates. Finally, we used a loop to plot both rates in a single figure.