AR Model#

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Slides

AR(\(p\)) Model#

The AR(\(p\)) model is: \(y_t = \phi_1 y_{t-1} + \phi_2 y_{t-2} + \dots + \phi_p y_{t-p} + \varepsilon_t\)

\(\phi_1\), \(\phi_2\), \(\ldots\), \(\phi_p\) are the autoregressive parameters that quantify the influence of past values on the current value

\(\varepsilon_t\) is white noise error term (or innovation) with mean zero and constant variance, \(\sigma^2\)

AR(\(1\)) Model#

An AR(\(1\)) Model is a special case of the AR(\(p\))

\[ y_t = \phi y_{t-1} + \varepsilon_t \]An AR(\(1\)) is often used to model cyclical dynamics

e.g., the fluctuations in an AR(1) series where \(\phi = 0.95\) appear much more persistent (i.e., smoother) than those where \(\phi = 0.4\)

AR(\(1\)) for any mean#

An AR(\(1\)) model is covariance stationary if \(|\phi| < 1\)

Suppose \(E[y_t] = E[y_{t-1}] \equiv \bar{y}\)

Then \(E[y_t] = 0\) since \(E[y_t] = \phi E[y_{t-1}] + E[\varepsilon_t] \rightarrow (1-\phi)\bar{y} = 0 \rightarrow \bar{y} = 0\)

Instead consider the AR(1) model with a generic mean: \(y_t - \mu = \phi(y_{t-1} - \mu) + \varepsilon_t\)

Then \(E[y_t] = \mu\) since

\[\begin{align*} E[y_t] - \mu &= \phi E[y_{t-1}] -\phi\mu + E[\varepsilon_t] \\ \rightarrow (1-\phi)\bar{y} &= (1-\phi)\mu \\ \rightarrow \bar{y} &= \mu \end{align*}\]You can rearrange the (any mean) AR(1) model as \(y_t = (1-\phi)\mu + \phi y_{t-1} + \varepsilon_t\)

AR(1) as MA(\(\infty\))#

The AR(1) model structure is the same at all points in time

\[\begin{align*} y_t &= \phi y_{t-1} + \varepsilon_t \\ y_{t-1} &= \phi y_{t-2} + \varepsilon_{t-1} \\ y_{t-2} &= \phi y_{t-3} + \varepsilon_{t-2} \end{align*}\]Combine, i.e., recursively substitute, to get \(y_t = \phi^3 y_{t-3} + \phi^2 \varepsilon_{t-2}+ \phi \varepsilon_{t-1} + \varepsilon_t\)

Rinse and repeat to get \(y_t = \sum_{i=0}^\infty \phi^i \varepsilon_{t-i}\) (i.e., the MA(\(\infty\)) Model or Wold Representation)

And an MA(\(\infty\)) is invertible back to an AR(\(1\)) so long as \(|\phi| < 1\).

An AR model that can be written as an MA(\(\infty\)) is causal (or exhibits causality).

That property differentiates it from an invertible MA model, which can be expressed as an AR(\(\infty\)) model.

Variance#

Suppose \(\mu=0\) without loss of generality.

Given \(Var(\varepsilon_t) = \sigma^2\) and \(|\phi| < 1\), then \(\gamma(0) \equiv Var(y_t)\)

\[\begin{align*} &= Var\left(\sum_{i=0}^\infty \phi^i \varepsilon_{t-i}\right) \\ &= Var(\varepsilon_t + \phi \varepsilon_{t-1} + \phi^2 \varepsilon_{t-2} + \phi^3 \varepsilon_{t-3} + \phi^4 \varepsilon_{t-4} + \cdots) \\ &= \sigma^2 + \phi^2 \sigma^2 + (\phi^2)^2 \sigma^2 + (\phi^3)^2 \sigma^2 + (\phi^4)^2 \sigma^2 + \cdots \\ &= \sigma^2(1 + \phi^2 + (\phi^2)^2 + (\phi^2)^3 + (\phi^2)^4 + \cdots ) \\ &= \sigma^2/(1-\phi^2) \end{align*}\]See Geometric Series.

\(Std(y_t) = \sqrt{\sigma^2/(1-\phi^2)}\)

Autocorrelation#

\(\gamma(1) = E[y_t y_{t-1}]\)

\[\begin{align*} &= E[(\phi y_{t-1} + \varepsilon_t)y_{t-1}] \\ &= E[\phi y_{t-1}^2] + E[\varepsilon_t y_{t-1}] \\ &= \phi Var[y_{t-1}] + 0 \\ &= \phi \gamma(0) \\ &= \phi \sigma^2/(1-\phi^2) \end{align*}\]\(\rho(1) = \gamma(1)/\gamma(0) = \phi\)

\(\gamma(2) = E[y_t y_{t-2}] = E[(\phi^2y_{t-2} + \varepsilon_t + \phi \varepsilon_{t-1})y_{t-2}] = \phi^2 E[y_{t-2}^2] = \phi^2 \gamma(0)\)

\(\rho(2) \equiv \gamma(2)/\gamma(0) = \phi^2\)

In general, \(\rho(k) = \phi^k\), which is a very nice looking ACF.

Thus, for an AR(\(1\)) process/model we can refer to \(\phi\) as the autocorrelation (AC) parameter/coefficient.

AR Model as DGP#

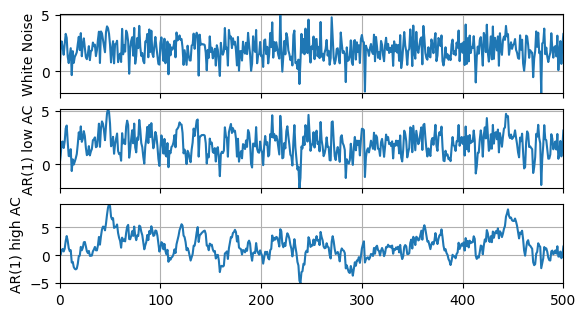

Let’s compare a couple different AR models to their underlying white noise.

White noise:

\[ y_t = \mu + \varepsilon_t \]AR(1), low AC:

\[ y_t = (1-\phi_l)\mu + \phi_l y_{t-1} + \varepsilon_t \]AR(1), high AC:

\[ y_t = (1-\phi_h)\mu + \phi_h y_{t-1} + \varepsilon_t \]

# Libraries

import numpy as np

# Assign parameters

T = 501; mu = 2; phi_l = 0.5; phi_h = 0.9;

# Draw random numbers

rng = np.random.default_rng(seed=0)

eps = rng.standard_normal(T)

# Simulate time series

y = np.zeros([T,3])

for t in range(1,T):

y[t,0] = mu + eps[t]

y[t,1] = (1-phi_l)*mu + phi_l*y[t-1,1] + eps[t]

y[t,2] = (1-phi_h)*mu + phi_h*y[t-1,2] + eps[t]

# Libraries

import pandas as pd

# Convert to DataFrame and plot

df = pd.DataFrame(y)

df.columns = ['White Noise','AR(1) low AC','AR(1) high AC']

# libraries

import matplotlib.pyplot as plt

# Plot variables

fig, axs = plt.subplots(len(df.columns),figsize=(6.5,3.5))

for idx, ax in enumerate(axs.flat):

col = df.columns[idx]; y = df[col]

ax.plot(y); ax.set_ylabel(col)

ax.grid(); ax.autoscale(tight=True); ax.label_outer()

print(f'{col}: \

E(y) = {y.mean():.2f}, Std(y) = {y.std():.2f}, \

AC(y) = {y.corr(y.shift(1)):.2f}')

White Noise: E(y) = 1.97, Std(y) = 1.02, AC(y) = -0.02

AR(1) low AC: E(y) = 1.94, Std(y) = 1.16, AC(y) = 0.48

AR(1) high AC: E(y) = 1.72, Std(y) = 2.18, AC(y) = 0.88

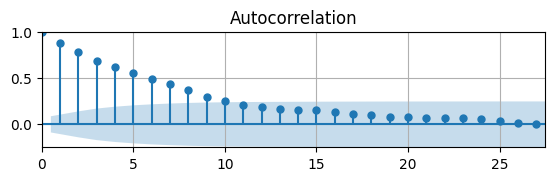

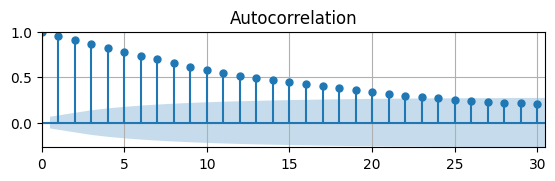

# Auto-correlation function

from statsmodels.graphics.tsaplots import plot_acf as acf

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

acf(df['AR(1) high AC'],ax)

ax.grid(); ax.autoscale(tight=True);

# ARIMA model

from statsmodels.tsa.arima.model import ARIMA

# Define model

mod = ARIMA(df['AR(1) high AC'],order=(1,0,0))

# Estimate model

res = mod.fit()

summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

# print(tab0); print(tab1); print(tab2)

Estimation Results#

| Dep. Variable: | AR(1) high AC | No. Observations: | 501 |

|---|---|---|---|

| Model: | ARIMA(1, 0, 0) | Log Likelihood | -718.607 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 1.6774 | 0.390 | 4.302 | 0.000 | 0.913 | 2.442 |

| ar.L1 | 0.8843 | 0.021 | 41.211 | 0.000 | 0.842 | 0.926 |

| sigma2 | 1.0282 | 0.059 | 17.442 | 0.000 | 0.913 | 1.144 |

| Heteroskedasticity (H): | 1.14 | Skew: | -0.15 |

|---|---|---|---|

| Prob(H) (two-sided): | 0.41 | Kurtosis: | 3.45 |

Parameter estimates are close to DGP and significantly different from \(0\)

Residuals have skewness near \(0\) and kurtosis near \(3\) so they are probably normally distributed

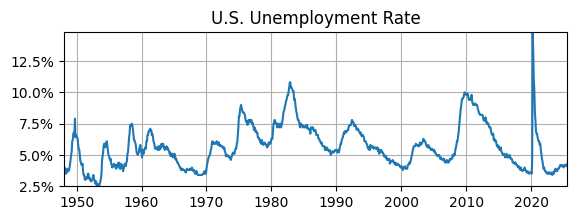

Modeling UR as AR(\(1\))#

The U.S. unemployment rate is very persistent.

What if we model it with an AR(1)?

# Libraries

from fredapi import Fred

import pandas as pd

# Read Data

fred_api_key = pd.read_csv('fred_api_key.txt', header=None)

fred = Fred(api_key=fred_api_key.iloc[0,0])

data = fred.get_series('UNRATE').to_frame(name='UR')

data.index = pd.DatetimeIndex(data.UR.index.values,freq=data.UR.index.inferred_freq)

# Plot

fig, ax = plt.subplots(figsize=(6.5,2));

ax.plot(data.UR); ax.set_title('U.S. Unemployment Rate');

ax.yaxis.set_major_formatter('{x:,.1f}%')

ax.grid(); ax.autoscale(tight=True)

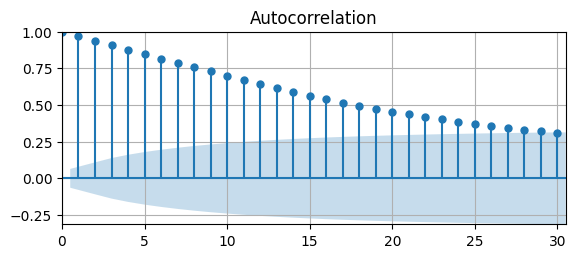

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,2.5))

acf(data.UR,ax);

ax.grid(); ax.autoscale(tight=True)

The ACF decays very slow \(\rightarrow\) UR might be non-stationary.

Let’s assume it is stationary for a moment and estimate an AR(\(1\)) model

# ARIMA model

from statsmodels.tsa.arima.model import ARIMA

# Define model

mod = ARIMA(data.UR,order=(1,0,0))

# Estimate model

res = mod.fit()

summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

#print(tab0); print(tab1); print(tab2)

Estimation Results#

| Dep. Variable: | VALUE | No. Observations: | 925 |

|---|---|---|---|

| Model: | ARIMA(1, 0, 0) | Log Likelihood | -496.551 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 5.5470 | 0.761 | 7.289 | 0.000 | 4.055 | 7.039 |

| ar.L1 | 0.9704 | 0.008 | 122.023 | 0.000 | 0.955 | 0.986 |

| sigma2 | 0.1708 | 0.001 | 159.798 | 0.000 | 0.169 | 0.173 |

| Heteroskedasticity (H): | 6.35 | Skew: | 16.87 |

|---|---|---|---|

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 428.90 |

Estimate of AR coeffecient is very high at \(0.9704\), but the data is not a random walk

Residuals are skewed and have excess kurtosis \(\rightarrow\) model is missing nonlinearity

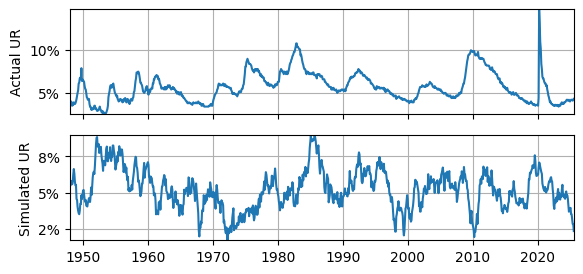

Actual vs. Simulated Data#

What if we simulated data from AR(1) model setting the parameters to the previous estimates?

What does a simulation from this estimated model look like?

# Assign parameters

T = len(data.UR); mu = 5.547; rho = 0.9704; sigma = np.sqrt(0.1708);

# Draw random numbers

rng = np.random.default_rng(seed=0)

eps = rng.standard_normal(T)

# Simulate time series

URsim = mu*np.ones([T,1])

for t in range(1,T):

URsim[t,0] = (1-rho)*mu + rho*URsim[t-1,0] + sigma*eps[t];

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

acf(URsim,ax)

ax.grid(); ax.autoscale(tight=True);

This ACF approaches zero at shorter lags compared to the actual data.

We know an AR(\(1\)) model with \(\phi = 0.9704\) generates stationary time series.

Maybe the actual UR isn’t stationary?

# Add simulation to DataFrame

data['URsim'] = URsim

# Variables to plot and ylabel

plotme = [['UR','Actual UR'],['URsim','Simulated UR']]

# Plot variables

fig, axs = plt.subplots(len(plotme),figsize=(6.5,3))

for idx, ax in enumerate(axs.flat):

y = data[plotme[idx][0]]; ylabel = plotme[idx][1]

ax.plot(y); ax.set_ylabel(ylabel)

ax.yaxis.set_major_formatter('{x:.0f}%')

ax.grid(); ax.autoscale(tight=True); ax.label_outer()

print(f'{ylabel}: \

E(y) = {y.mean():.2f}, Std(y) = {y.std():.2f}, \

AC(y) = {y.corr(y.shift(1)):.2f}')

Actual UR: E(y) = 5.67, Std(y) = 1.71, AC(y) = 0.97

Simulated UR: E(y) = 5.21, Std(y) = 1.35, AC(y) = 0.95

Does it fit?#

The actual UR is very smooth, but the AR(1) model is not.

The simulated UR often falls below \(2\%\), whereas the actual UR does not.

The actual UR meets or exceeds \(10\%\) a few times, whereas the simulated UR does not.

The actual UR rises quickly and falls slowly, whereas the simulated UR seems to rise and fall at roughly the same rates.

This all suggests that the AR(1) model is unable to reproduce some important features of the actual UR.

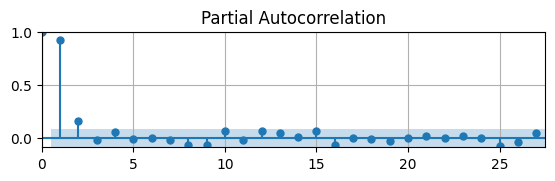

Partial ACF#

Most of the slides in this chapter are about the AR(\(1\)) model.

Suppose the true DGP is an AR model, but we do not know the order.

When the DGP is a MA model, we can use the ACF to determine the order since it drops off to zero after a certain lag.

But for AR model, the autocorrelation at higher lags is influenced by the intermediate observations between \(t\) and \(t-k\), and even for an AR(\(1\)) model the ACF tapers slowly.

Alternatively, Partial ACF (PACF) helps to identify the order of an AR model.

The PACF at lag \(k\) is the correlation between \(y_t\) and \(y_{t-k}\) that is not explained by observations in between, \(\{y_{t-k+1}:y_{t-1}\}\)

The PACF at lag \(k\) is denoted as \(\phi_{kk}\), and plotting \(\phi_{kk}\) against lag \(k\) forms the PACF plot.

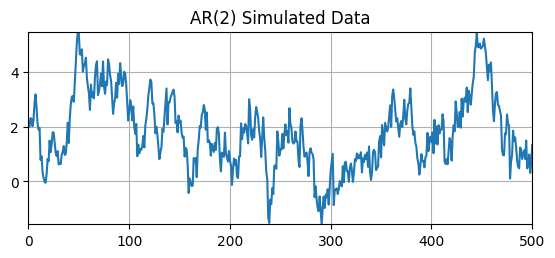

AR(\(2\)) Model#

Let’s simulate the following AR(\(2\)) model

\[ y_t = (1-\phi_1-\phi_2)\mu + \phi_1 y_{t-1} + \phi_2 y_{t-2} + \sigma \varepsilon_t \]where \(\mu = 2\), \(\phi_1 = 0.8\), \(\phi_2 = 0.15\), and \(\sigma = 0.5\)

We know the DGP and the true order of the AR model. Does the PACF suggest the same order?

# Assign parameters

T = 501; mu = 2; phi_1 = 0.8; phi_2 = 0.15; sigma = 0.5;

# Draw random numbers

rng = np.random.default_rng(seed=0)

eps = rng.standard_normal(T)

# Simulate time series

y = mu*np.ones([T,1])

for t in range(2,T):

y[t,0] = (1-phi_1-phi_2)*mu + phi_1*y[t-1,0] + phi_2*y[t-2,0] + sigma*eps[t]

# Convert to DataFrame and plot

df = pd.DataFrame(y)

fig, ax = plt.subplots(figsize=(6.5,2.5))

ax.plot(df); ax.set_title('AR(2) Simulated Data')

ax.grid(); ax.autoscale(tight=True)

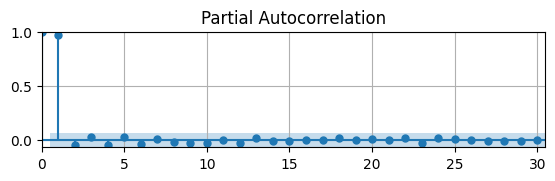

# Partial auto-correlation function

from statsmodels.graphics.tsaplots import plot_pacf as pacf

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

pacf(df,ax)

ax.grid(); ax.autoscale(tight=True);

The PACF is significantly different from zero for \(k = \{1,2\}\), which indicates the DGP is probably an AR(\(2\)).

So the PACF is good at deterimining order so long as AR coefficients are large enough.

Modeling UR as AR(\(2\))#

Is a higher order AR model a good fit for the U.S. unemployment rate?

Let’s first plot the PACF of the UR to see if we can determine an order.

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

pacf(data.UR,ax);

ax.grid(); ax.autoscale(tight=True)

This suggests that an AR(1) might be the best model.

What if we ignore the PACF and estimate an AR(2) anyway?

# Define model

mod = ARIMA(data.UR,order=(2,0,0))

# Estimate model

res = mod.fit()

summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

#print(tab0); print(tab1); print(tab2)

Estimation Results#

| Dep. Variable: | VALUE | No. Observations: | 925 |

|---|---|---|---|

| Model: | ARIMA(2, 0, 0) | Log Likelihood | -495.314 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 5.5611 | 0.740 | 7.510 | 0.000 | 4.110 | 7.012 |

| ar.L1 | 1.0208 | 0.009 | 109.007 | 0.000 | 1.002 | 1.039 |

| ar.L2 | -0.0517 | 0.010 | -5.057 | 0.000 | -0.072 | -0.032 |

| sigma2 | 0.1703 | 0.001 | 143.540 | 0.000 | 0.168 | 0.173 |

| Heteroskedasticity (H): | 6.37 | Skew: | 16.65 |

|---|---|---|---|

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 423.48 |

Both AR coefficients are significantly different from \(0\)

But the AR(2) is still linear, i.e., normal and symmetric, so the residuals are still skewed and fat-tailed

PACF did not help to determine that second lag might improve fit

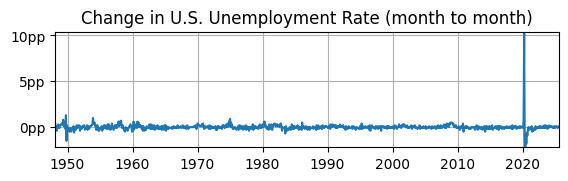

UR First Difference#

# Year-over-year growth rate

dUR = data.UR.diff(1); dUR = dUR.dropna()

# Plot

fig, ax = plt.subplots(figsize=(6.5,1.5));

ax.plot(dUR); ax.set_title('Change in U.S. Unemployment Rate (month to month)');

ax.yaxis.set_major_formatter('{x:,.0f}pp'); ax.grid(); ax.autoscale(tight=True)

Is it stationary?

Yes, mean looks constant around \(0\).

Yes, volatility looks constant, except for COVID.

Maybe not, it’s impossible to see if the autocovariance is constant.

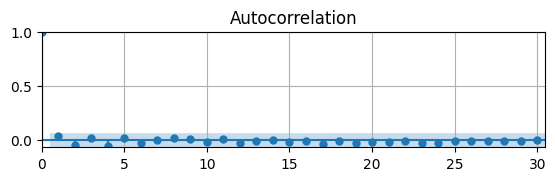

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

acf(dUR,ax)

ax.grid(); ax.autoscale(tight=True);

The ACF indicates that the series is probably stationary.

What does the PACF say?

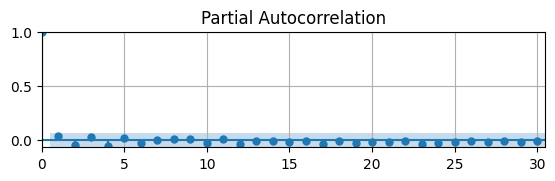

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

pacf(dUR,ax);

ax.grid(); ax.autoscale(tight=True)

The PACF shows that the autocorrelation is not significantly different from zero for all lags.

What is the best model to estimate? Let’s try MA(\(1\)) and AR(\(1\)) and compare.

Estimation Results#

# Define model

mod0 = ARIMA(dUR,order=(0,0,1))

mod1 = ARIMA(dUR,order=(1,0,0))

# Estimate model

res = mod1.fit(); summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

#print(tab0); print(tab1); print(tab2)

| Dep. Variable: | VALUE | No. Observations: | 924 |

|---|---|---|---|

| Model: | ARIMA(0, 0, 1) | Log Likelihood | -500.699 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0007 | 0.025 | 0.027 | 0.979 | -0.047 | 0.049 |

| ma.L1 | 0.0398 | 0.008 | 4.893 | 0.000 | 0.024 | 0.056 |

| sigma2 | 0.1731 | 0.001 | 185.366 | 0.000 | 0.171 | 0.175 |

| Heteroskedasticity (H): | 6.54 | Skew: | 16.40 |

|---|---|---|---|

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 419.10 |

The MA coefficient estimate is statistically significantly different from \(0\).

However, the residuals are still probably heteroskedastic and not normally distributed.

Thus, a linear/normal model is probably not the best choice.

| Dep. Variable: | VALUE | No. Observations: | 924 |

|---|---|---|---|

| Model: | ARIMA(1, 0, 0) | Log Likelihood | -500.757 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0007 | 0.025 | 0.026 | 0.979 | -0.048 | 0.049 |

| ar.L1 | 0.0363 | 0.008 | 4.344 | 0.000 | 0.020 | 0.053 |

| sigma2 | 0.1731 | 0.001 | 185.413 | 0.000 | 0.171 | 0.175 |

| Heteroskedasticity (H): | 6.55 | Skew: | 16.42 |

|---|---|---|---|

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 419.51 |

The AR coefficient is small/weak but estimate is statistically significantly different from \(0\).

Like the MA(\(1\)) model, the residuals are still probably heteroskedastic and not normally distributed.

This again confirms that a linear/normal model is probably not the best choice.