MA Model#

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Slides

Wold Representation Theorem#

Wold representation theorem: any covariance stationary series can be expressed as a linear combination of current and past white noise.

\[ y_t = \sum_{i=0}^\infty b_i \varepsilon_{t-i} \]\(\varepsilon_t\) is a white noise process with mean 0 and variance \(\sigma^2\).

\(b_0 = 1\), and \(|\sum_{i=0}^\infty b_i | < \infty\), which ensures the process is stable.

\(\varepsilon_t\), a.k.a. an innovation, represents new information that cannot be predicted using past values.

Key aspects#

Generality: The Wold Representation is a general model that can represent any covariance stationary time series. This is why it is important for forecasting.

Linearity: The representation is a linear function of its innovations or “general linear process”.

Zero Mean: The theorem applies to zero-mean processes, but this is without loss of generality because any covariance stationary series can be expressed in deviations from its mean, \(y_t-\mu\).

Innovations: The Wold representation expresses a time series in terms of its current and past shocks/innovations.

Approximation: In practice, because an infinite distributed lag isn’t directly usable, models like moving average (MA), autoregressive (AR), and autoregressive moving average (ARMA) models are used to approximate the Wold representation.

MA Model#

The moving average (MA) model expresses the current value of a series as a function of current and lagged unobservable shocks (or innovations)

The MA model of order \(q\), denoted as MA(\(q\)), is defined as:

\[ y_t = \mu + \varepsilon_t + \theta_1 \varepsilon_{t−1} + \theta_2 \varepsilon_{t−2} + ... + \theta_q \varepsilon_{t−q} \]\(\mu\) is the mean or intercept of the series.

\(\varepsilon_t\) is a white noise process with mean 0 and variance \(\sigma^2\).

\(\theta_1,\theta_2,\ldots,\theta_q\) are the parameters of the model.

Key aspects#

Stationarity: MA models are always stationary.

Approximation: Finite-order MA processes are a natural approximation to the Wold representation, which is MA(\(\infty\)).

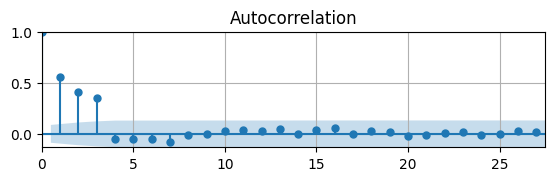

Autocorrelation: The ACF of an MA(\(q\)) model cuts off after lag \(q\), i.e., the autocorrelations are zero beyond displacement \(q\). This is helpful in identifying a suitable MA model for time series data.

Forecasting: MA models are not forecastable more than \(q\) steps ahead, apart from the unconditional mean, \(\mu\).

Invertibility: An MA model is invertible if it can be expressed as an autoregressive model with an infinite number of lags.

Unconditional Moments#

The variance of an MA process depends on the order of the process and the variance of the white noise, \(\varepsilon_t \overset{i.i.d.}{\sim} N(0,\sigma^2)\)

MA(\(1\)) Process: \(y_t = \mu + \varepsilon_t + \theta\varepsilon_{t-1}\)

\(E(y_t) = \mu + E(\varepsilon_t) + \theta E(\varepsilon_{t-1}) = \mu\)

\(Var(y_t) = Var(\varepsilon_t) + \theta^2 Var(\varepsilon_{t-1}) = \sigma^2(1 + \theta^2)\)

\(Std(y_t) = \sqrt{\sigma^2(1 + \theta^2)}\)

MA(\(q\)) Process: \(y_t = \mu + \varepsilon_t + \theta_1\varepsilon_{t-1} + \dots + \theta_q\varepsilon_{t-q}\)

\(E(y_t) = \mu\)

\(Var(y_t) = \sigma^2(1 + \theta_1^2 + \dots + \theta_q^2)\)

\(Std(y_t) = \sqrt{Var(y_t)}\)

Autocorrelation Function#

MA(\(1\)) Process: \(y_t = \mu + \varepsilon_t + \theta\varepsilon_{t-1}\)

\(\gamma(0) = E[(y_t-\mu)(y_t-\mu)] = Var(y_t) = \sigma^2(1 + \theta^2)\)

\(\gamma(1) = E[(y_t-\mu)(y_{t-1}-\mu)]\)

\[\begin{align*} &= E[(\varepsilon_t + \theta\varepsilon_{t-1})(\varepsilon_{t-1} + \theta\varepsilon_{t-2})] \\ &= E[\varepsilon_t\varepsilon_{t-1} + \varepsilon_t\theta\varepsilon_{t-2} + \theta\varepsilon_{t-1}\varepsilon_{t-1} + \theta\varepsilon_{t-1}\theta\varepsilon_{t-2}] \\ &= \theta E[\varepsilon_{t-1}^2] = \theta Var[\varepsilon_{t-1}] \\ &= \theta\sigma^2 \end{align*}\]\(\gamma(\tau) = 0\) for \(|\tau| > 1\)

\(\rho(0) = 1\), i.e., any series is perfectly correlated with itself

\(\rho(1) = \gamma(1)/\gamma(0) = \theta/(1 + \theta^2)\)

\(\rho(\tau) = 0\) for \(|\tau| > 1\)

MA(\(q\)) process: \(y_t = \varepsilon_t + \theta_1\varepsilon_{t-1} + \dots + \theta_q\varepsilon_{t-q}\)

\(\rho(0) = 1\)

\(\rho(k) = \frac{\theta_k + \sum_{i=1}^{q-k} \theta_i\theta_{i+k}}{1 + \sum_{i=1}^{q} \theta_i^2}\) for \(1 \le k \le q\)

\(\rho(\tau) = 0\) for \(|\tau| > q\)

MA Model as DGP#

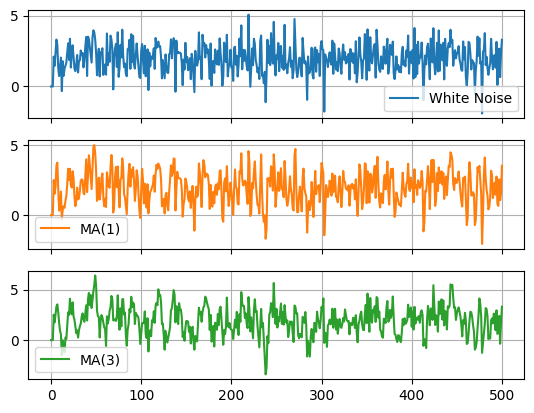

Let’s compare a couple different MA models to their underlying white noise.

White noise:

MA(1):

MA(3):

# Import libraries

# Plotting

import matplotlib.pyplot as plt

# Scientific computing

import numpy as np

# Data analysis

import pandas as pd

DIY simulation#

# Assign parameters

T = 501; mu = 2; theta1 = 0.6; theta2 = 0.5; theta3 = 0.7;

# Draw random numbers

rng = np.random.default_rng(seed=0)

eps = rng.standard_normal(T)

# Simulate time series

y = np.zeros([T,3])

for t in range(3,T):

y[t,0] = mu + eps[t]

y[t,1] = mu + eps[t] + theta1*eps[t-1]

y[t,2] = (mu + eps[t] + theta1*eps[t-1]

+ theta2*eps[t-2] + theta3*eps[t-3])

# Convert to DataFrame and plot

df = pd.DataFrame(y)

df.columns = ['White Noise','MA(1)','MA(3)']

df.plot(subplots=True,grid=True)

array([<Axes: >, <Axes: >, <Axes: >], dtype=object)

# Plot variables

fig, axs = plt.subplots(len(df.columns),figsize=(6.5,3.5))

for idx, ax in enumerate(axs.flat):

col = df.columns[idx]

y = df[col]

ax.plot(y); ax.set_ylabel(col)

ax.grid(); ax.autoscale(tight=True); ax.label_outer()

print(f'{col}: \

E(y) = {y.mean():.2f}, \

Std(y) = {y.std():.2f}, \

AC(y) = {y.corr(y.shift(1)):.2f}')

White Noise: E(y) = 1.96, Std(y) = 1.03, AC(y) = -0.01

MA(1): E(y) = 1.95, Std(y) = 1.18, AC(y) = 0.43

MA(3): E(y) = 1.92, Std(y) = 1.43, AC(y) = 0.58

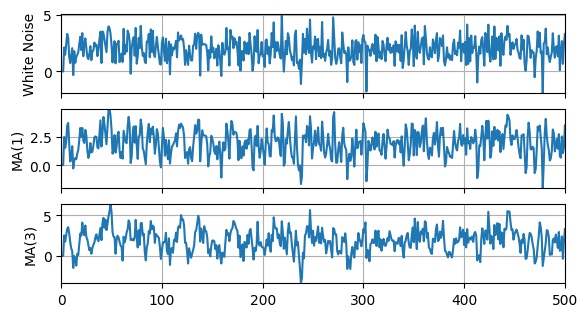

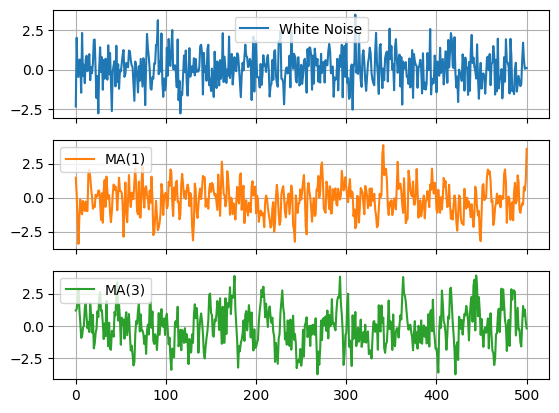

Using statsmodels#

# ARIMA Process

from statsmodels.tsa.arima_process import ArmaProcess as arma

# Set rng seed

rng = np.random.default_rng(seed=0)

# Create models (coefficients include zero lag)

wn = arma(ma=[1]);

ma1 = arma(ma=[1,theta1])

ma3 = arma(ma=[1,theta1,theta2,theta3])

# Simulate models

y = np.zeros([T,3])

y[:,0] = wn.generate_sample(T)

y[:,1] = ma1.generate_sample(T)

y[:,2] = ma3.generate_sample(T)

# Convert to DataFrame

df = pd.DataFrame(y)

df.columns = ['White Noise','MA(1)','MA(3)']

df.plot(subplots=True,grid=True)

array([<Axes: >, <Axes: >, <Axes: >], dtype=object)

# Auto-correlation function

from statsmodels.graphics.tsaplots import plot_acf as acf

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

acf(df['MA(3)'],ax)

ax.grid(); ax.autoscale(tight=True);

Since the DGDP is an MA(3), the ACF shows the correlations are only significant for the first 3 lags.

Estimating MA Model#

In an MA model, the current value is expressed as a function of current and lagged unobservable shocks.

However, the error terms are not observed directly and must be inferred from the data and estimated parameters.

This creates a nonlinear relationship between the data and the model’s parameters.

The

statsmodelsmodule has a way to define an MA model and estimate its parameters.The general model is Autoregressive Integrated Moving Average Model, or ARIMA(\(p,d,q\)), of which MA(\(q\)) is a special case.

The argument

order=(p,d,q)specifies the order for the autoregressive, integrated, and moving average components.See statsmodels for more information.

# ARIMA model

from statsmodels.tsa.arima.model import ARIMA

# Define model

mod = ARIMA(df['MA(3)'],order=(0,0,3))

# Estimate model

res = mod.fit()

summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

# print(tab0); print(tab1); print(tab2)

| Dep. Variable: | MA(3) | No. Observations: | 501 |

|---|---|---|---|

| Model: | ARIMA(0, 0, 3) | Log Likelihood | -700.202 |

| Date: | Wed, 05 Feb 2025 | AIC | 1410.405 |

| Time: | 14:24:16 | BIC | 1431.488 |

| Sample: | 0-501 | HQIC | 1418.677 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.1391 | 0.125 | -1.114 | 0.265 | -0.384 | 0.106 |

| ma.L1 | 0.6199 | 0.033 | 18.713 | 0.000 | 0.555 | 0.685 |

| ma.L2 | 0.5248 | 0.037 | 14.251 | 0.000 | 0.453 | 0.597 |

| ma.L3 | 0.6949 | 0.034 | 20.158 | 0.000 | 0.627 | 0.762 |

| sigma2 | 0.9540 | 0.064 | 14.819 | 0.000 | 0.828 | 1.080 |

| Ljung-Box (L1) (Q): | 0.09 | Jarque-Bera (JB): | 1.32 |

|---|---|---|---|

| Prob(Q): | 0.76 | Prob(JB): | 0.52 |

| Heteroskedasticity (H): | 1.08 | Skew: | 0.08 |

| Prob(H) (two-sided): | 0.61 | Kurtosis: | 2.80 |

Invertibility of MA(\(1\))#

Suppose \(y_t = \varepsilon_t + \theta \varepsilon_{t−1}\) and \(|\theta| < 1\).

Rearrange to get \(\varepsilon_t = y_t - \theta \varepsilon_{t−1}\), which holds at all points in time, e.g.,

\[\begin{align*} \varepsilon_{t-1} &= y_{t-1} - \theta \varepsilon_{t−2} \\ \varepsilon_{t-2} &= y_{t-2} - \theta \varepsilon_{t−3} \end{align*}\]Combine these (i.e., recursively substitute) to get an \(AR(\infty)\) Model

\[ \varepsilon_t = y_t - \theta y_{t-1} - \theta^2 y_{t-2} - \theta^3 y_{t-3} - \cdots = y_t - \sum_{j=1}^\infty \theta^j y_{t-j} \]or

\[ y_t = \sum_{j=1}^\infty \theta^j y_{t-j} + \varepsilon_t \]The innovation, \(\varepsilon_t\) (something unobservable), can be “inversely” expressed by the data, but that’s only possible if \(|\theta| < 1\).