IS-LM-PC Model

by Professor Throckmorton

for Intermediate Macro

W&M ECON 304

Slides

Summary¶

Okun’s Law: negative relationship between output, , and the unemployment rate,

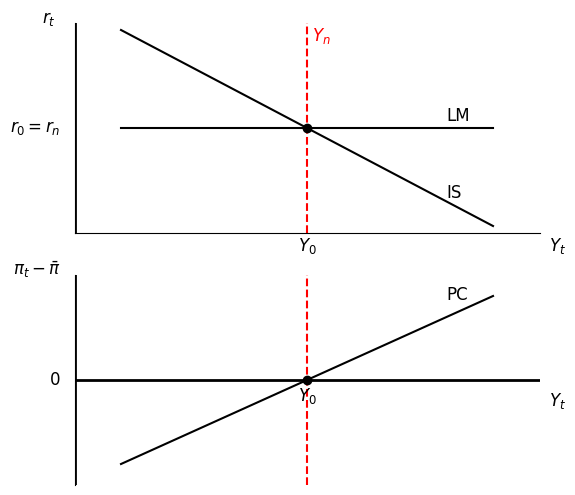

Real vs. nominal interest rate and the medium-run IS-LM-PC equilibrium

IS-LM-PC: short-run vs. medium-run equilibrium

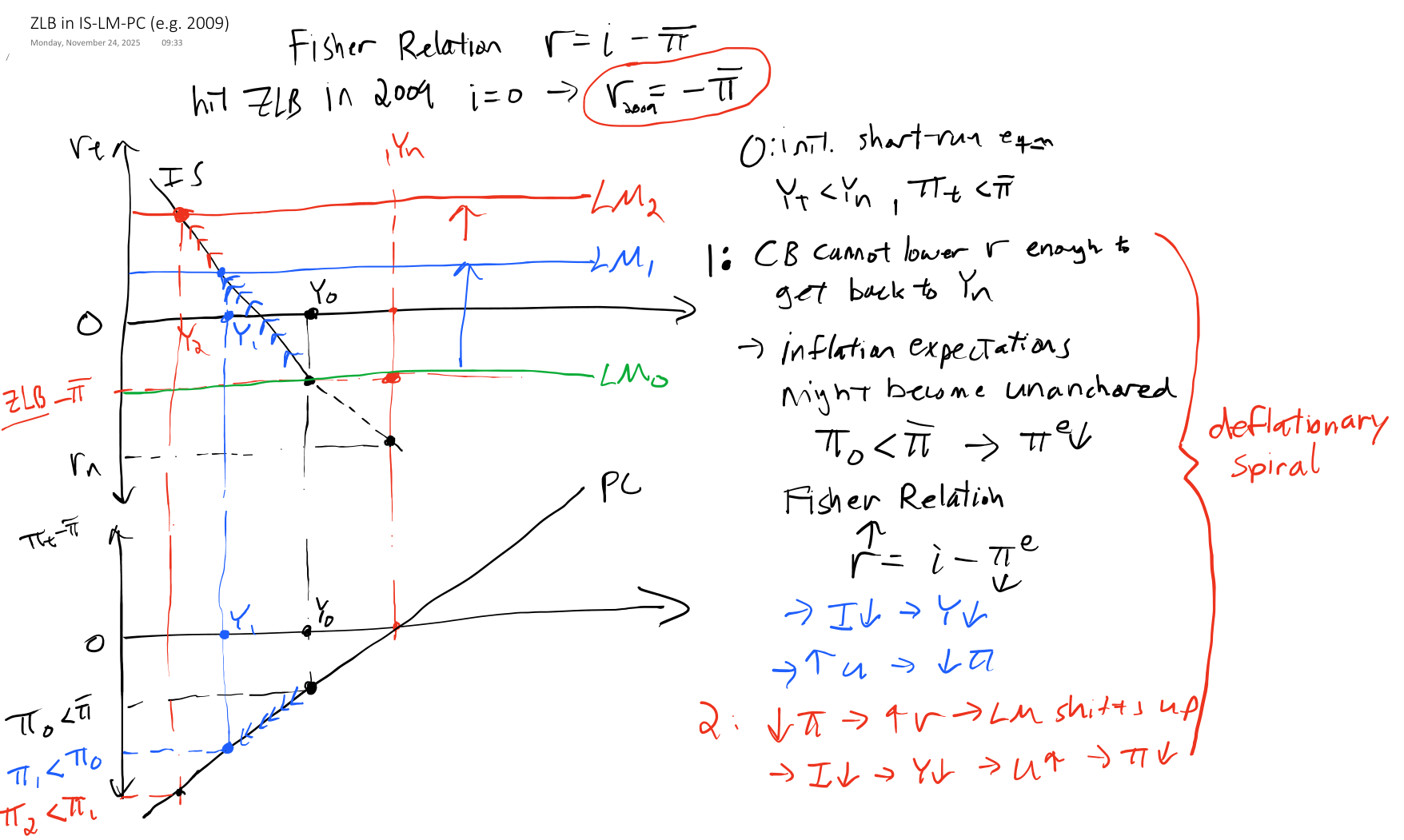

Q: What does a recession look like in the model?The ZLB and Deflationary Spirals

Okun’s Law¶

IS-LM model is in the space, but Phillips Curve is in the space.

To combine IS-LM and PC, we will first transform the PC into the space.

To do that, we need Okun’s law, which is a negative relationship between output, , and unemployment rate, , relative to the medium-run equilibrium

Recall these labor market definitions: and

For the labor market, we assumed the production function is , so we can also substitute out for ,

i.e., unemployment rate and output are negatively related (by definition)

Rearrange and add time subscripts (assuming is constant in short run)

Note that equation also holds in the medium run, , i.e., the natural unemployment rate implies a natural, or potential, output level.

Subtract the medium-run equation from the short-run equation:

This is Okun’s Law.

Substitute Okun’s Law into Phillips Curve

Inflation vs. Output¶

Again, suppose , i.e., expectations are anchored, and the central bank is credible

If (eqm), then is stable at the Fed’s target

If (recession), then falls below the Fed’s target

If (boom), then rises above the Fed’s target

This version of the Phillips Curve appears in the IS-LM-PC model and is equation 9.4 in Blanchard, Macroeconomics (9th Edition, 2025).

Real vs. Nominal Interest Rate¶

Recall the simple loan example from the Money Market. Suppose you lend me dollars, and next year I will pay you back

where the nominal interest rate, , we agree on ahead of time

Q: What is the real value of that future payment today?

A:: expected price of goods and services next year

: the real interest rate (in terms of goods, not dollars)

Problems: It’s not in terms of the inflation rate. And it’s a nonlinear relationship, which is difficult to use/interpret.

Substitute in inflation rate

Recall the definition of the inflation rate

Combine that with real interest rate

Nonlinear linear

Recall the properties of natural log

Take natural log of both sides

Note are small

Approximate (since is small)

i.e., the real interest rate equals the nominal rate minus expected inflation

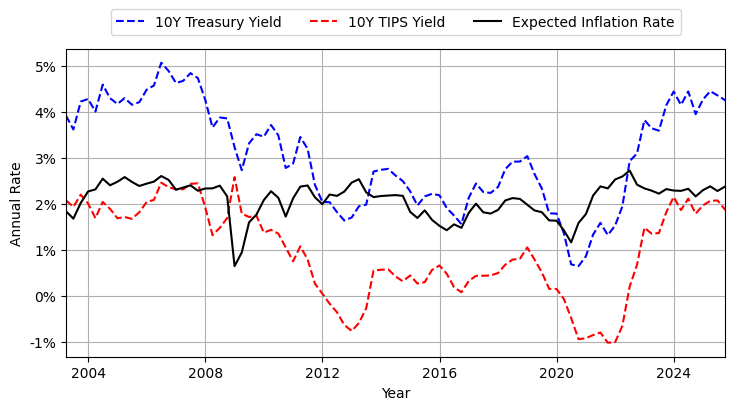

Fisher Relation Examples

Fisher Relation

Note that in the U.S.

2008-2015: Suppose and (annual rates)

Note the real interest rate can be negative!

Great Depression: and (deflation)

Note that the real interest rate can be greater than the nominal rate, and that really hurts borrowers! (debt deflation)

Data Example

Source

# This script began as a copy-paste from a previous script in this book

# Then it was modified with the help of GitHub Copilot

# Finally, it was manually edited for accuracy and aesthetics

# Libraries

from fredapi import Fred

import pandas as pd

# Read data

fred_api_key = pd.read_csv('fred_api_key.txt', header=None).iloc[0,0]

fred = Fred(api_key=fred_api_key)

data = fred.get_series('DGS10').to_frame(name='10Y Treasury Yield')

# append unemployment rate to data

data['10Y TIPS Yield'] = fred.get_series('DFII10')

# append difference column to data

data['Expected Inflation Rate'] = data['10Y Treasury Yield'] - data['10Y TIPS Yield']

# reindex data to QE by averaging quarterly

data = data.resample('QE').mean()

# remove data before 2003

data = data[data.index.year >= 2003]

# create list with 3 line types, one for each column

line_types = ['--b', '--r', '-k']

# plot all columns of data with loop

import matplotlib.pyplot as plt

plt.figure(figsize=(8.5,4))

for i, column in enumerate(data.columns):

plt.plot(data.index, data[column], line_types[i], label=column)

plt.xlabel('Year')

plt.ylabel('Annual Rate')

plt.legend()

# add grid lines

plt.grid()

# orient legend horizontally and relocate to outside top center

plt.legend(loc='upper center', ncol=len(data.columns), bbox_to_anchor=(0.5, 1.15))

# set xlims to 2003-04-01 to 2025-9-30

plt.xlim(pd.Timestamp('2003-04-01'), pd.Timestamp('2025-09-30'))

# add % to ylabels

plt.gca().yaxis.set_major_formatter(plt.FuncFormatter(lambda y, _: '{:.0f}%'.format(y)))

10Y TIPS principal is indexed to inflation, so price is higher than 10Y (non-indexed) Treasury and yield is lower.

Difference in yields is a measure of expected inflation rate (which is an application of the Fisher relation)

Implied expected inflation rate is usually the Fed’s target of 2%

Goods Market in medium-run¶

Medium-run equilibrium defined by (Labor Market, PC, and Okun’s Law)

Substitute into goods market short-run equilibrium

Note investment is function of real interest rate.

Assuming , , , and are fixed, then the only other variable in equation is . Thus,

in a medium-run equilibrium.

is the natural real interest rate, often called the “neutral rate” since when .

IS-LM-PC Graph¶

Source

# This script began as a ChatGPT-5.1 translation of a hand-drawn figure

# It was then modified with the help of GitHub Copilot

# It was then manually edited for accuracy and aesthetics

import numpy as np

import matplotlib.pyplot as plt

# Set up figure

fig, axes = plt.subplots(2, 1, figsize=(6, 6))

# -------------------------

# 1. IS–LM diagram (top)

# -------------------------

ax1 = axes[0]

# Axes limits

xmax = 10

ymax = 6

ax1.set_xlim(0, xmax)

ax1.set_ylim(0, ymax)

# Remove ticks

ax1.set_xticks([])

ax1.set_yticks([])

# Draw axes manually

#ax1.axhline(0, color='black', linewidth=2)

ax1.axvline(0, color='black', linewidth=2)

# Equilibrium point

Yn = 5

rn = 3

# Vertical red line at Yn

ax1.axvline(Yn, color='red', linestyle='--', linewidth=1.5)

# IS curve

Y = np.linspace(1, xmax-1, 100)

IS = rn - 0.7*(Y - Yn)

ax1.plot(Y, IS, color='black')

# LM curve

LM = rn + 0*(Y - Yn)

ax1.plot(Y, LM, color='black')

# Equilibrium point

ax1.plot(Yn, rn, 'ko')

# Labels

ax1.text(xmax+.2, -0.5, "$Y_t$", fontsize=12)

ax1.text(-0.7, 6, "$r_t$", fontsize=12)

ax1.text(8, rn+.2, "LM", fontsize=12)

ax1.text(8, rn-2, "IS", fontsize=12)

ax1.text(Yn + 0.1, 5.5, "$Y_n$", color="red", fontsize=12)

ax1.text(Yn, -0.5, "$Y_0$", fontsize=12, ha='center')

ax1.text(-0.3, rn, "$r_0 = r_n$", fontsize=12, va='center',ha='right')

# -------------------------

# 2. Phillips Curve diagram (bottom)

# -------------------------

ax2 = axes[1]

# Axes limits

ax2.set_xlim(0, 10)

ax2.set_ylim(-5, 5)

# Remove ticks

ax2.set_xticks([])

ax2.set_yticks([])

# Draw axes manually

ax2.axhline(0, color='black', linewidth=2)

ax2.axvline(0, color='black', linewidth=2)

# Vertical red line at Yn

ax2.axvline(Yn, color='red', linestyle='--', linewidth=1.5)

# Phillips curve

PC = 0 + 1*(Y - Yn)

ax2.plot(Y, PC, color='black')

# Equilibrium point

ax2.plot(Yn, 0, 'ko')

# Labels

ax2.text(xmax+.2, -1, "$Y_t$", fontsize=12, va='center')

ax2.text(-.3, 5, r"$\pi_t-\bar{\pi}$", fontsize=12,ha='right')

ax2.text(8, 3.8, "PC", fontsize=12)

ax2.text(Yn, -1, "$Y_0$", fontsize=12, ha='center')

ax2.text(-.3, 0, "0", fontsize=12, va='center',ha='right')

# remove upper and right box from both plots

for ax in axes:

ax.spines['top'].set_visible(False)

ax.spines['right'].set_visible(False)

# remove bottom box from bottom plot

axes[1].spines['bottom'].set_visible(False)

Experiments¶