Goods Market

by Professor Throckmorton

for Intermediate Macro

W&M ECON 304

Slides

Introduction¶

In Part 1, we looked at different ways of accounting for GDP and comparing GDP per capita and its growth rate across countries.

The Solow growth model made dynamic predictions about income per worker given assumptions about the nature of production, capital, and investment.

In that model, we focused on the effects of capital accumulation, technological growth, and the savings rate on income per worker over the long run.

While , the growth model was about explaining investment, not consumption.

In Part 2, we will abstract from capital accumulation and turn our attention to the short run, first focusing on household consumption.

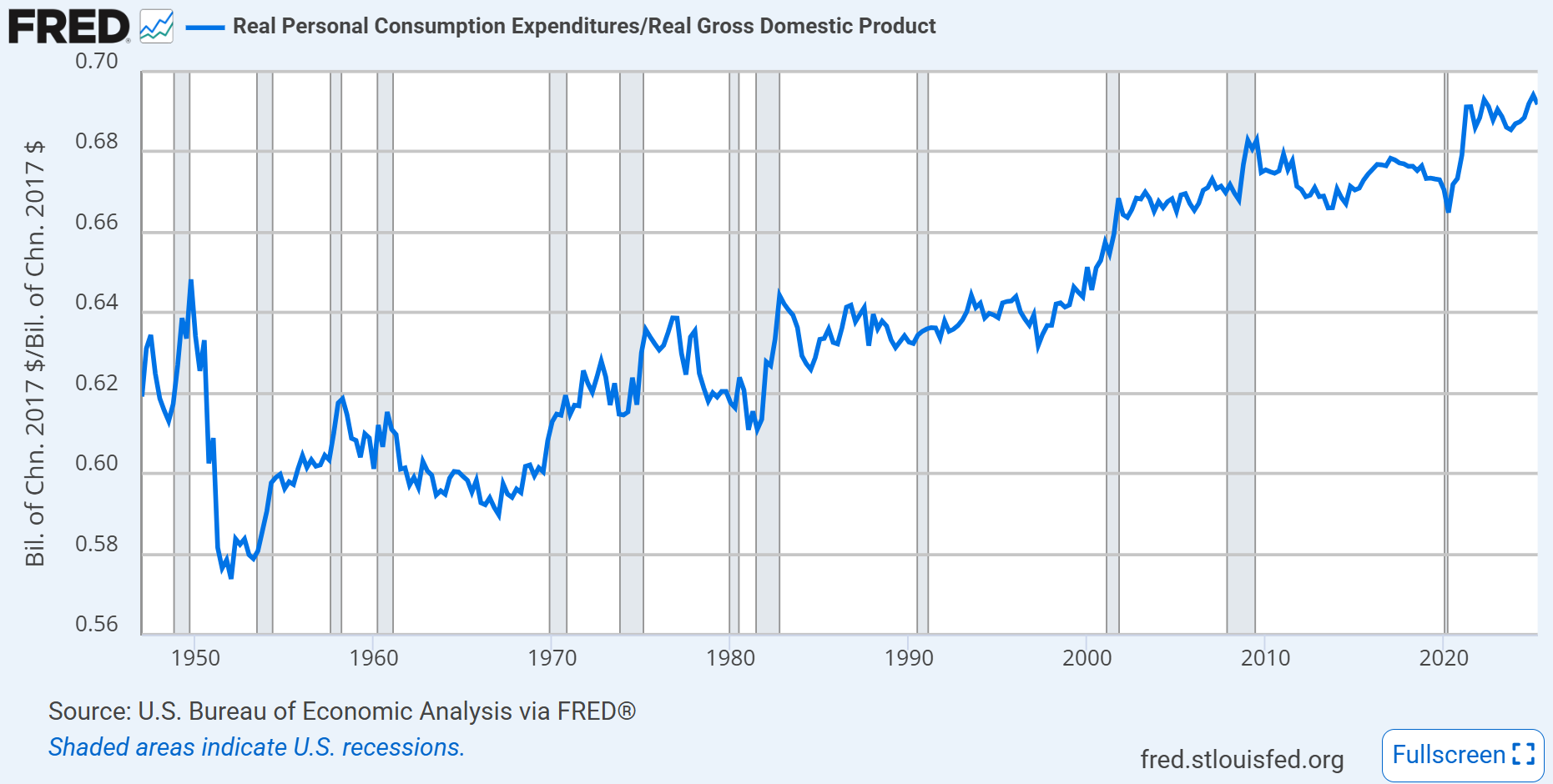

Q: Why Consumption?

The consumption share of GDP is the largest component, larger than investment, government spending, and net exports.

The consumption share of GDP has increased over time.

Of course this is quite different between high and low income countries, but high income countries generally have a large share of consumption to GDP.

Consumption Function¶

Assume that aggregate consumption is a function of disposable income

is income, while is net tax revenue. Thus, is disposable income available to households.

Note: is net tax revenue because some households receive transfers from the government, e.g., Social Security payments and medical expenses paid via Medicare

Parameters

quantifies the fraction of current disposable income consumed by households

In the language of micro, we might call it the “consumption elasticity of disposable income”

In the language of macro, most people call it the “marginal propensity to consume” (MPC)

If there were low and high income households in the model, which do you think would have a higher average MPC?

is all consumption that is independent of current disposable income. Imagine if , then

households could dissave and consume out of their wealth, or

households could borrow against their wealth or future income to consume.

Aggregate Expenditure¶

In Ch. 2, the expenditure approach to GDP is

In the Solow growth model, we abstract from and and just had

In Part 2, we’ll work with a closed economy but consider changes in government spending, so

But we need to separate the expenditure (i.e., demand) side apart from the supply side, so let be aggregate supply/output and aggregate expenditure is

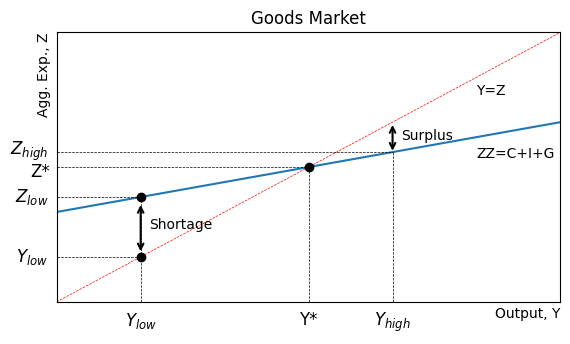

In equilibrium, , but there are disequilibria where

Disequilibrium Equilibrium

If , there is excess supply

Inventories would accumulate

Firms would probably decrease production

If , there is excess expenditure

Inventories would deplete

Firms would probably increase production

Either way, there is a tendency for to move toward , and thus is an equilibrium.

Endogneous Variables¶

So far, the model has variables

We’ve assumed is a function of and in equilibrium, , i.e., is a function of . These are known as endogenous variables.

However, we have not assumed functions for (yet). They are variables and could change, but they do not explicitly depend on or (yet). These are known as exogenous variables.

We can also treat parameters as exogenous variables, e.g., in the growth model we considered the effects of an increasing in the savings rate (a parameter).

For example, we could consider a financial crisis that reduces asset prices a reduction in househould wealth that is reflected by a decrease in . Another way to think of that is falling consumer confidence.

The Multiplier¶

The goods market in equilibrium has 3 equations

(a behavioral equation)

(an accounting identity)

(an equilibrium condition)

The main prediction this model makes is that an exogenous change in expenditure is multiplied into a larger endogenous change in equilibrium income/output.

That result is known as Income Multiplication (or the Keynesian Multiplier).

Multiplier Example

Suppose an Infrastructure Spending Bill is passed, or by

Aggregate expenditure, , directly increases by

Firms see higher demand for their outputs, e.g., increased orders for steel, cement, and construction equipment and vehicles, so they increase production, also by (on impact)

Households receive more income and they consume an additional

But is part of , so the loop repeats, i.e, the initial change in government spending multiplies into additional income over time.

| Multiplier Step | ||

|---|---|---|

| 0 | ||

| 1 | ||

| 2 | ||

| 3 | ||

| ... | ... | ... |

Since we’ve assumed , each additional step is adding a smaller amount to income/output.

Add up the column and we get

In other words, the multiplication process is represented by a geometric series (see the Wiki on that).

E.g., suppose and , then

is known as the government spending multiplier in this model.

Equilibrium Output¶

The goods market makes predictions about output/income, .

Q: How do changes in exogenous variables affect ?

Combining the goods markets equations (imposing that the model is in equilibrium)

Solving for equilibrium output,

are all exogenous parameters/variables at the moment.

Other Multipliers

From the solution for equilbrium output, we can see the government spending multiplier (which is the same as the earlier example)

An exogenous change in investment has the same multiplier

However, an exogenous change in net taxes has a different multiplier because households first choose consumption vs. savings and a change in net taxes has the opposite effect on consumption (than a change in governement spending).

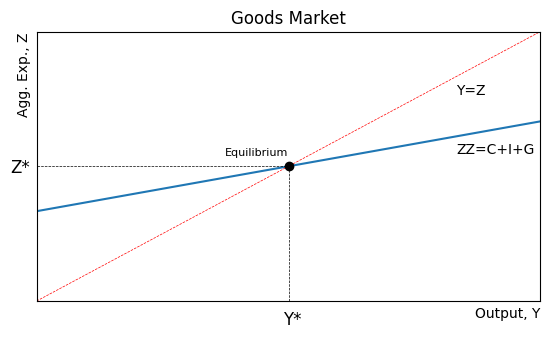

Goods Market Graph¶

The goods market graph will show output, , vs expenditure, .

Blanchard, Macroeconomics (9th Edition, 2025) introduces new notation for a graph of aggregate expenditure and calls it .

differentiates the aggregate expenditure function from particular realizations of aggregate expenditure that we label as just on the vertical axis.

Source

import numpy as np

import matplotlib.pyplot as plt

x = np.linspace(0, 40, 100)

y = 10 + x/3

plt.figure(figsize=(6.5, 3.5))

plt.plot(x, y)

plt.xlim(0, 30)

plt.ylim(0, 30)

plt.xlabel('Output, Y', loc='right')

plt.ylabel('Agg. Exp., Z', loc='top')

plt.title('Goods Market')

plt.grid()

plt.axhline(0, color='black',linewidth=0.5, ls='--')

# add line for 45 degree line from origin

plt.plot(x, x, color='red', linewidth=0.5, ls='--')

# add label for 45 degree line that says Y=Z

plt.text(25, 23, 'Y=Z', color='black')

# add label for expenditure line that says ZZ=C+I+G

plt.text(25, 16.5, 'ZZ=C+I+G', color='black')

# label the equilibrium point on the graph

plt.plot(15, 15, marker='o', color='black')

plt.text(15, 16, 'Equilibrium', fontsize=8, verticalalignment='bottom', horizontalalignment='right')

# put Y* = 15 on horizontal axis

plt.text(15.2, -1, 'Y*', fontsize=12, verticalalignment='top', horizontalalignment='center')

# put dashed vertical line between horizon axis and equilibrium point

plt.axvline(15, ymin=0, ymax=0.5, color='black', linewidth=0.5, ls='--')

# put horizontal dashed line between vertical axis and equilibrium point

plt.axhline(15, xmin=0, xmax=0.5, color='black', linewidth=0.5, ls='--')

plt.text(-1, 15.9, 'Z*', fontsize=12, verticalalignment='top', horizontalalignment='center')

# remove x and y labels and ticks

plt.xticks([]); plt.yticks([]);

Source

import numpy as np

import matplotlib.pyplot as plt

x = np.linspace(0, 40, 100)

y = 10 + x/3

plt.figure(figsize=(6.5, 3.5))

plt.plot(x, y)

plt.xlim(0, 30)

plt.ylim(0, 30)

plt.xlabel('Output, Y', loc='right')

plt.ylabel('Agg. Exp., Z', loc='top')

plt.title('Goods Market')

plt.grid()

plt.axhline(0, color='black',linewidth=0.5, ls='--')

# add line for 45 degree line from origin

plt.plot(x, x, color='red', linewidth=0.5, ls='--')

# add label for 45 degree line that says Y=Z

plt.text(25, 23, 'Y=Z', color='black')

# add label for expenditure line that says ZZ=C+I+G

plt.text(25, 16, 'ZZ=C+I+G', color='black')

# label the equilibrium point on the graph

plt.plot(15, 15, marker='o', color='black')

# put Y* = 15 on horizontal axis

plt.text(15, -1, 'Y*', fontsize=12, verticalalignment='top', horizontalalignment='center')

# put dashed vertical line between horizon axis and equilibrium point

plt.axvline(15, ymin=0, ymax=0.5, color='black', linewidth=0.5, ls='--')

# put horizontal dashed line between vertical axis and equilibrium point

plt.axhline(15, xmin=0, xmax=0.5, color='black', linewidth=0.5, ls='--')

plt.text(-1, 15.5, 'Z*', fontsize=12, verticalalignment='top', horizontalalignment='center')

# Put dot on 45 degree line at (5,5)

plt.plot(5, 5, marker='o', color='black')

# put dashed vertical line between horizon axis and aggregate expenditure line

plt.axvline(5, ymin=0, ymax=0.39, color='black', linewidth=0.5, ls='--')

# label the point (5,5) with Y_low

plt.text(5, -1, '$Y_{low}$', fontsize=12, verticalalignment='top', horizontalalignment='center')

# put dashed horizontal line between vertical axis and (5,5)

plt.axhline(5, xmin=0, xmax=5/30, color='black', linewidth=0.5, ls='--')

# label the point (5,5) with Y_low on the vertical axis

plt.text(-0.5, 5, '$Y_{low}$', fontsize=12, verticalalignment='center', horizontalalignment='right')

# put dashed horizontal line between vertical axis and aggregate expenditure line at X=5

plt.axhline(11.7, xmin=0, xmax=5/30, color='black', linewidth=0.5, ls='--')

# label the point (5,11.7) with Z_low on the vertical axis

plt.text(-0.5, 11.7, '$Z_{low}$', fontsize=12, verticalalignment='center', horizontalalignment='right')

# put a dot on the expenditure line at (5,11.7)

plt.plot(5, 11.7, marker='o', color='black')

# put a vertical curly brace between (5,5) and (5,11.7)

plt.annotate('', xy=(5, 5.3), xytext=(5, 11.1), arrowprops={'arrowstyle': '<->', 'lw':1.5})

# label the vertical arrow with "shortage"

plt.text(5.5, 8.5, 'Shortage', fontsize=10, verticalalignment='center')

# remove x and y labels and ticks

plt.xticks([]); plt.yticks([]);

# add y label at 20

plt.text(-0.5, 16.7, '$Z_{high}$', fontsize=12, verticalalignment='center', horizontalalignment='right')

# add x label at 20

plt.text(20, -1, '$Y_{high}$', fontsize=12, verticalalignment='top', horizontalalignment='center')

# put dashed vertical line between horizon axis and aggregate expenditure line at X=20

plt.axvline(20, ymin=0, ymax=16.7/30, color='black', linewidth=0.5, ls='--')

# put dashed horizontal line between vertical axis and aggregate expenditure line at Y=20

plt.axhline(16.7, xmin=0, xmax=20/30, color='black', linewidth=0.5, ls='--')

# put a vertical curly brace between (20,12) and (20,20)

plt.annotate('', xy=(20, 16.5), xytext=(20, 20), arrowprops={'arrowstyle': '<->', 'lw':1.5})

# label the vertical arrow with "surplus"

plt.text(20.5, 18.5, 'Surplus', fontsize=10, verticalalignment='center');

If output is below equilibrium, then expenditure exceeds output, .

In micro language, we would call that a shortage. But in macro, excess expenditure could be met with inventories (i.e., past production).

Excess expenditure creates an unplanned decrease in inventories, which is an incentive for firms to increase output.

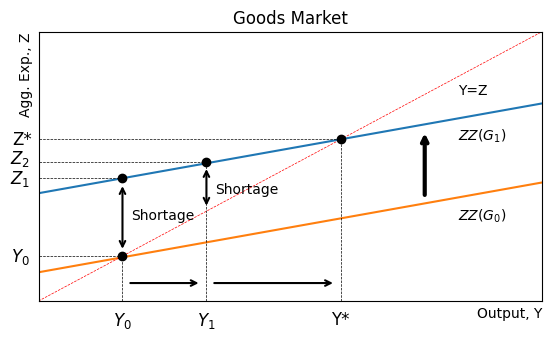

Experiment¶

Suppose from to .

An exogenous increase in will shift up the curve.

That creates excess expenditure, which depletes inventories.

Firms increase production to replenish inventories.

That leads to higher consumption and income multiplies until the new equilibrium is reached.

Source

import numpy as np

import matplotlib.pyplot as plt

x = np.linspace(0, 40, 100)

y = 12 + x/3

plt.figure(figsize=(6.5, 3.5))

plt.plot(x, y)

# Shift aggregate expenditure line down by 7 units

plt.plot(x, y-8.8)

plt.xlim(0, 30)

plt.ylim(0, 30)

plt.xlabel('Output, Y', loc='right')

plt.ylabel('Agg. Exp., Z', loc='top')

plt.title('Goods Market')

plt.grid()

plt.axhline(0, color='black',linewidth=0.5, ls='--')

# add line for 45 degree line from origin

plt.plot(x, x, color='red', linewidth=0.5, ls='--')

# add label for 45 degree line that says Y=Z

plt.text(25, 23, 'Y=Z', color='black')

# add label for expenditure line that says ZZ(G_0)

plt.text(25, 9, '$ZZ(G_0)$', color='black')

# add label for expenditure line that says ZZ(G_1)

plt.text(25, 18, '$ZZ(G_1)$', color='black')

# label the equilibrium point on the graph

plt.plot(18, 18, marker='o', color='black')

# put Y* = 15 on horizontal axis

plt.text(18, -1, 'Y*', fontsize=12, verticalalignment='top', horizontalalignment='center')

# put dashed vertical line between horizon axis and equilibrium point

plt.axvline(18, ymin=0, ymax=18/30, color='black', linewidth=0.5, ls='--')

# put horizontal dashed line between vertical axis and equilibrium point

plt.axhline(18, xmin=0, xmax=18/30, color='black', linewidth=0.5, ls='--')

plt.text(-1, 19, 'Z*', fontsize=12, verticalalignment='top', horizontalalignment='center')

# Put dot on 45 degree line at (5,5)

plt.plot(5, 5, marker='o', color='black')

# put dashed vertical line between horizon axis and aggregate expenditure line

plt.axvline(5, ymin=0, ymax=5/30, color='black', linewidth=0.5, ls='--')

# label the point (5,5) with Y_low

plt.text(5, -1, '$Y_0$', fontsize=12, verticalalignment='top', horizontalalignment='center')

# put dashed horizontal line between vertical axis and (5,5)

plt.axhline(5, xmin=0, xmax=5/30, color='black', linewidth=0.5, ls='--')

# label the point (5,5) with Y_low on the vertical axis

plt.text(-0.5, 5, '$Y_0$', fontsize=12, verticalalignment='center', horizontalalignment='right')

# put dashed horizontal line between vertical axis and aggregate expenditure line at X=5

plt.axhline(13.7, xmin=0, xmax=5/30, color='black', linewidth=0.5, ls='--')

# label the point (5,11.7) with Z_low on the vertical axis

plt.text(-0.5, 13.7, '$Z_1$', fontsize=12, verticalalignment='center', horizontalalignment='right')

# put a dot on the expenditure line at (5,11.7)

plt.plot(5, 13.7, marker='o', color='black')

# put a vertical curly brace between (5,5) and (5,11.7)

plt.annotate('', xy=(5, 5.5), xytext=(5, 13.1), arrowprops={'arrowstyle': '<->', 'lw':1.5})

# label the vertical arrow with "shortage"

plt.text(5.5, 9.5, 'Shortage', fontsize=10, verticalalignment='center')

# remove x and y labels and ticks

plt.xticks([]); plt.yticks([]);

# label horizontal axis at 10 Y_1

plt.text(10, -1, '$Y_1$', fontsize=12, verticalalignment='top', horizontalalignment='center')

# add vertical dashed line at Y_1

plt.axvline(10, ymin=0, ymax=15.5/30, color='black', linewidth=0.5, ls='--')

# add dot at (10,15) on the expenditure line

plt.plot(10, 15.5, marker='o', color='black')

# add vertical axis label at 15.5 Z_2

plt.text(-0.5, 17, '$Z_2$', fontsize=12, verticalalignment='top', horizontalalignment='right')

# add horizontal dashed line at Z_2

plt.axhline(15.5, xmin=0, xmax=10/30, color='black', linewidth=0.5, ls='--')

# add right arrrow between 5 and 11 on just above the horizontal axis

plt.annotate('', xy=(5.3, 2), xytext=(9.7, 2), arrowprops={'arrowstyle': '<-', 'lw':1.5})

# add right arrrow between 5 and 11 on just above the horizontal axis

plt.annotate('', xy=(10.3, 2), xytext=(17.7, 2), arrowprops={'arrowstyle': '<-', 'lw':1.5})

# put a vertical curly brace between (5,5) and (5,11.7)

plt.annotate('', xy=(10, 10.3), xytext=(10, 15), arrowprops={'arrowstyle': '<->', 'lw':1.5})

# label the vertical arrow with "shortage"

plt.text(10.5, 12.5, 'Shortage', fontsize=10, verticalalignment='center');

# add a big up arrow on the right side between the two aggregate expenditure lines

plt.annotate('', xy=(23, 11.5), xytext=(23, 19), arrowprops={'arrowstyle': '<-', 'lw':3});

Savings¶

Define private saving as disposable income not consumed, .

Define public saving as net tax revenue minus government spending,

Note that in a goods market equilibrium .

Subtract from both sides and move to the left hand side

Thus, in equilibrium investment equals saving.

In an open economy, investment would also depend on foreign savings, i.e.,