Financial Markets

by Professor Throckmorton

for Intermediate Macro

W&M ECON 304

Slides

Summary¶

Define present value and arbitrage

Arbitrage equal expected returns, i.e., a financial market equilibrium

Define Yield-to-maturity and interpret the yield curve

Derive relationship between interest rates and stock prices

Present Value¶

Present value is the current worth of a future payment or stream of payments, discounted back using an appropriate interest rate to reflect the time value of money.

Applying present value allows us to price any asset, e.g., bond, stock, mortgage

Since present value depends on market expectations, current asset prices have information about expectations

| Today () | Next year () | in 2 years () |

|---|---|---|

Asset pays principal plus (expected) interest, compounding over time

Present value of received next year is discounted by

Present value of received in 2 years is discounted by

What’s important is to discount future cash flow according to when it’s received.

Recall a simple loan/one-period zero-coupon discount bond (e.g., T-Bill)

Current market price equals face value (future cash-flow) discounted to present by interest rate

is initial investment/loan given by market price, Face Value is known, this implies an interest rate, (a.k.a. yield to maturity)

Arbitrage¶

General use: buy thing at low price in one market and sell it at a higher price in a different market

For example, you could buy laptops for cash on college campuses and then list them on ebay at a higher price.

In finance, arbitrage refers to buying/selling assets depending on relative expected returns

For example, sell an asset with a high price/low expected return, then buy a different asset with low price/high expected return.

Goal: maximize expected return on a portfolio of assets

Portfolio Choice¶

Properties of bonds

Credit/default risk: who issued them and what’s the risk premium/spread?

Maturity: how long until bond pays face value?

Discount/Coupons: does bond also pay coupons?

Consider a small portfolio

Credit/default risk: bonds issued by U.S. government, so no default/credit risk

Maturity: either 1 or 2 years

1-year bond has price and pays in 1 year

2-year bond has price and pays in 2 years

Discount/Coupons: discount bonds only, no coupons, e.g., Treasury bills

2-year bond is transferable and could be sold after 1 year

Q: What is price of 2-year bond with 1-year left?

A: The price of a 1-year bond at that time.

Q: How do we manage this portfolio?

| Choice | This year () | Next year () | in 2 years () |

|---|---|---|---|

| A: Buy 1-year bond | — | ||

| B: Buy 2-year bond |

To compare cashflow next year, sell the 2-year bond next year at expected 1-year bond price, .

Divide by bond price to “invest” in each choice.

The return on worth of a 1-year bond is vs. the expected return on worth of a 2-year bond, which is

Goal: maximize expected return on portfolio

1-year bond return:

2-year bond expected return:

Three possible cases:

Disequilibrium (arbitrage opportunity):

sell 1-year () and buy 2-year ()

expected returns equalizeDisequilibrium (arbitrage opportunity):

buy 1-year () and sell 2-year ()

expected returns equalizeEquilibrium: (equal returns)

no incentive to rebalance portfolios

Cases 1) and 2) are arbitrage opportunities that lead to the equilibrium where there is no more arbitrage.

Equilibrium 2-year Bond Price¶

In equilibrium, 1-year return expected 2-yr return

Recall present value formula for 1-year bond price

Combine those

Update 1-year bond price forward one year, take expectation

Substitute that into 2-year bond price

This is the present value (i.e., asset pricing) formula for a 2-year discount bond.

Yield to Maturity/Curve¶

Yield to Maturity (YtM): the annual interest rate a bond holder receives if bond is held to maturity

I.e., YtM is the constant interest rate that equates current bond price with present value of all future cash-flow, e.g., for an -year discount bond,

where is -year YtM

We know and cash flow, so we can calculate all YtM

Yield Curve: a graph/table of YtM as function of maturity for bonds that have same credit/default risk, e.g., U.S. Treasuries

Combine bond market equilibrium with YtM definition

Since numerators are equal, then denominators are equal

Equation is nonlinear, so let’s linearize it! Recall

where is the natural logarithm

Take logs and use properties

2-year YtM is average of 1-year rates

Expected 1-year rate (predicted)

Expectations Hypothesis¶

Expectations hypothesis: the long-term rate is determined purely by current and future expected short-term rates

Since we can calculate YtM from current bond prices, the expectations hypothesis leads to a prediction about expected future short-term rates

E.g, if falls, then also falls

Q: When would actually decrease?

A: When the central bank sets a lower rate (in a recession).

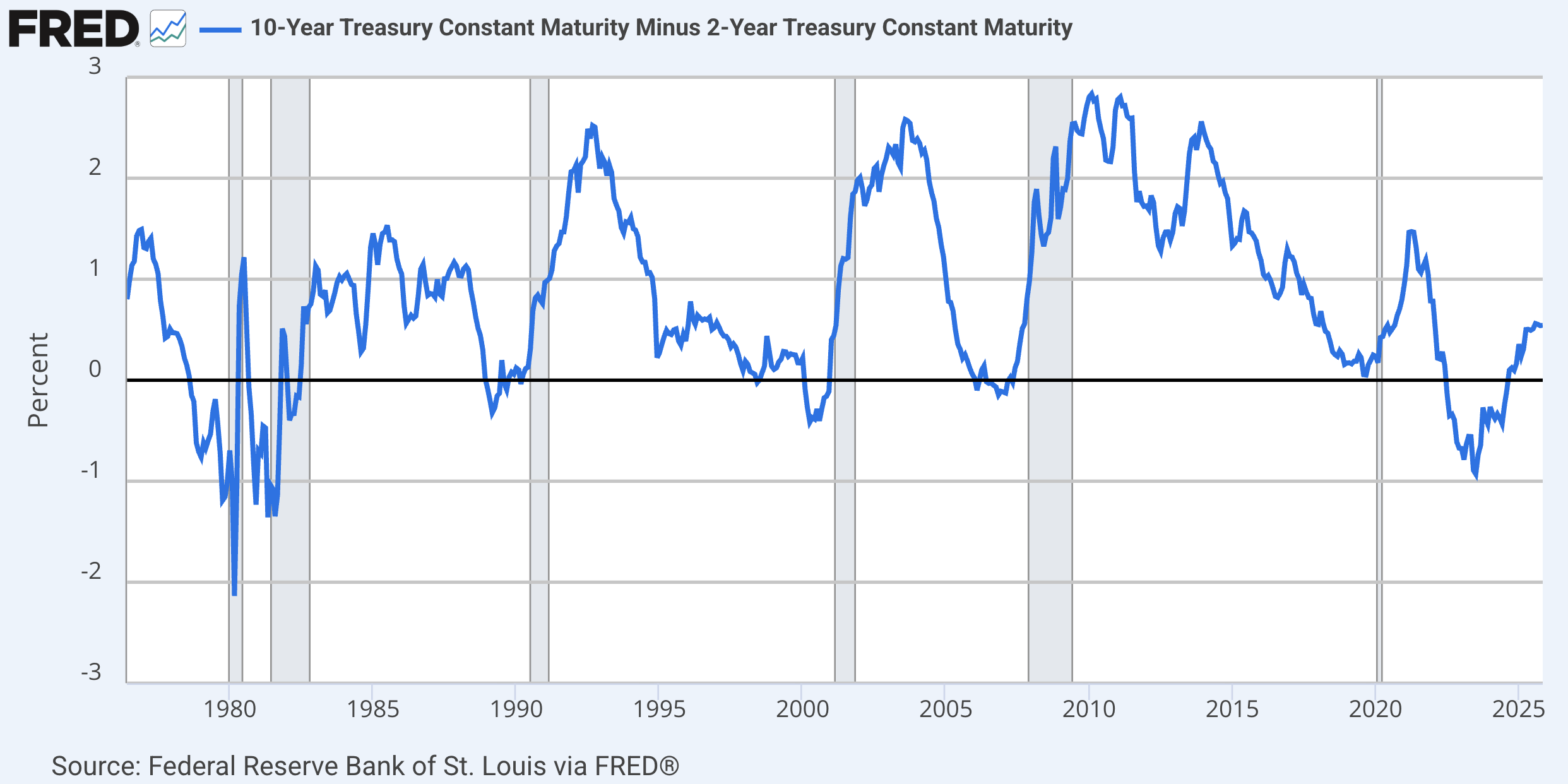

Expectations hypothesis gives three cases for interpreting yield curve

Upward sloping:

, i.e., central bank expected to raise rate

bond market expects boom/expansionDownward sloping ({\color{red} i.e., inverted}):

, i.e., central bank expected to lower rate

bond market expects bust/recessionFlat (typically before recessions):

bond market expecting move from boom to bust

It’s usually upward sloping, but downward sloping ()before recessions?

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity (T10Y2Y)

Stock Market¶

Bonds and stocks both store wealth (i.e., they are substitutable)

New goal: maximize expected return on portfolio of 1-yr bond and a stock

Stock characteristics

- is current price

- is expected dividend (e.g., random, could be zero)

- is expected future priceQ: What’s the cash flow on a stock if you sell it after a year?

A: The expected dividend plus the expected sale price.

Portfolio Choice Problem

| Choice | ||

|---|---|---|

| A: Buy 1-yr bond | ||

| B: Buy stock |

Normalize

Time horizon year

Initial investment

is the risk premium, i.e., the additional return the portfolio manager wants to compensate them for the price risk of holding a stock

Goal: Maximize expected portfolio return

Disequilibrium (arbitrage opportunity):

1-yr bond return expected stock return

sell 1-yr bond () and buy stock ()

expected returns equalizeDisequilibrium (arbitrage opportunity):

1-yr bond return expected stock return

buy 1-yr bond () and sell stock ()

expected returns equalizeEquilibrium: 1-yr bond return expected stock return

no incentive to reallocate portfolio

(equal expected returns / no more arbitrage opportunties)

Stock Price¶

Assume equilibrium and solve for (with risk premium)

Update one period and take expectation

Substitute 2 into 1

This is a present value formula for a stock.

Fundamental Value

Keep substituting out expected stock price

As , PV of expected stock price goes to zero

Prediction: the fundamental value of a stock is just the present value of all future dividends (for a given risk premium)

Stock Price Summary

Arbitrage equal expected returns between a bond and stock (for a given risk premium)

Stock price is positively related to expected dividends, i.e., expected future profitability

Stock price is negatively related to (current or expected) short-term interest rates, e.g., news of higher future short-term interest rates lowers stock price

If managers become more risk averse, then stock prices fall.

The fundamental value of a stock is just the present value of all future dividends.