VAR Example Fed

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Summary¶

Christiano et al. (2005): Christiano, Eichenbaum, and Evans “Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy” (Journal of Polical Economy, 2005) has over 9,000 citations (astronomical!) according to google scholar.

Let denote variables observed between 1965Q3 to 1995Q3,

: real GDP, real consumption, GDP deflator, real investment, real wages, and labor productivity

: federal funds rate

: real profits, M2 growth rate

Assumptions¶

appears after , i.e., the assumption is that none of the variables in respond contemporaneously to , so the real economy lags behind monetary policy (citing Friedman)

“All these variables, except money growth, have been natural logged.”

“With one exception (the growth rate of money), all the variables in are included in levels.”

“The VAR contains four lags of each variable, and the sample period is 1965:3–1995:3.”

Read Data¶

# Libraries

from fredapi import Fred

import pandas as pd

# Setup acccess to FRED

fred_api_key = pd.read_csv('fred_api_key.txt', header=None)

fred = Fred(api_key=fred_api_key.iloc[0,0])

# Series to get

series = ['GDP','PCE','GDPDEF','GPDI','COMPRNFB','OPHNFB','FEDFUNDS','CP','M2SL']

rename = ['gdp','cons','price','inv','wage','prod','ffr','profit','money']

# Get and append data to list

dl = []

for idx, string in enumerate(series):

var = fred.get_series(string).to_frame(name=rename[idx])

dl.append(var)

print(var.head(2)); print(var.tail(2)) gdp

1946-01-01 NaN

1946-04-01 NaN

gdp

2025-01-01 29962.047

2025-04-01 30331.117

cons

1959-01-01 306.1

1959-02-01 309.6

cons

2025-05-01 20615.2

2025-06-01 20685.2

price

1947-01-01 11.141

1947-04-01 11.299

price

2025-01-01 127.429

2025-04-01 128.059

inv

1939-01-01 NaN

1939-04-01 NaN

inv

2025-01-01 5595.694

2025-04-01 5372.966

wage

1947-01-01 34.386

1947-04-01 34.670

wage

2024-10-01 108.178

2025-01-01 108.496

prod

1947-01-01 22.256

1947-04-01 22.762

prod

2024-10-01 115.725

2025-01-01 115.303

ffr

1954-07-01 0.80

1954-08-01 1.22

ffr

2025-05-01 4.33

2025-06-01 4.33

profit

1946-01-01 NaN

1946-04-01 NaN

profit

2024-10-01 3631.383

2025-01-01 3602.551

money

1959-01-01 286.6

1959-02-01 287.7

money

2025-05-01 21883.6

2025-06-01 22020.8

# Concatenate data to create data frame (time-series table)

raw = pd.concat(dl, axis=1).sort_index()

# Resample/reindex to quarterly frequency

raw = raw.resample('QE').last().dropna()

# Display dataframe

display(raw)Transform Data¶

# Scientific computing

import numpy as np

data = pd.DataFrame()

# log real GDP

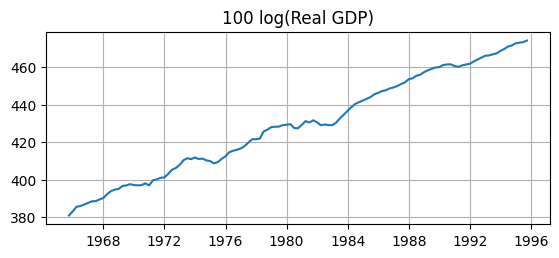

data['gdp'] = 100*(np.log(raw['gdp']/raw['price']))

# log real Consumption

data['cons'] = 100*(np.log(raw['cons']/raw['price']))

# log price level

data['price'] = 100*np.log(raw['price'])

# log real Investment

data['inv'] = 100*(np.log(raw['inv']/raw['price']))

# log real Wage

data['wage'] = 100*(np.log(raw['wage']/raw['price']))

# log labor productivity

data['prod'] = 100*np.log(raw['prod'])

# log federal funds rate

data['ffr'] = 100*np.log(raw['ffr'])

# log real Profits

data['profit'] = 100*(np.log(raw['profit']/raw['price']))

# M2 growth rate

data['money'] = 100*(raw['money']/raw['money'].shift(1)-1)# Christiano et al. (2005) sample

sample = data['09-30-1965':'09-30-1995']

display(sample)Non-stationarity¶

# Plotting

import matplotlib.pyplot as plt

# Plot GDP

fig, ax = plt.subplots(figsize=(6.5,2.5))

ax.plot(sample['gdp'])

ax.set_title('100 log(Real GDP)')

ax.grid()

Q: Do these transformations make the data stationary? A: Clearly not.

Sims et al. (1990) find that VARs in levels can yield consistent impulse response functions even if the variables are non-stationary, I(1), and cointegrated.

Fortunately, Christiano et al. (2005) is only concerned with estimating IRFs.

Cointegration¶

Suppose you have two non-stationary time series: and , both I(1).

Typically, any linear combination of them, , would also be non-stationary.

But if some linear combination is stationary, then the variables are cointegrated.

The coefficients (like ) form a cointegrating vector.

This implies the variables share a stable long-run relationship despite short-run fluctuations.

Example¶

Let be (i.e., income) and be (i.e., consumption)

Both series are non-stationary, I(1), because they have a stochastic time trend.

There might exist a linear combination that is stationary, I(0), meaning

Income and consumption have a long-run linear relationship, i.e., they are cointegrated.

Deviations from the long-run are mean-reverting.

Estimation¶

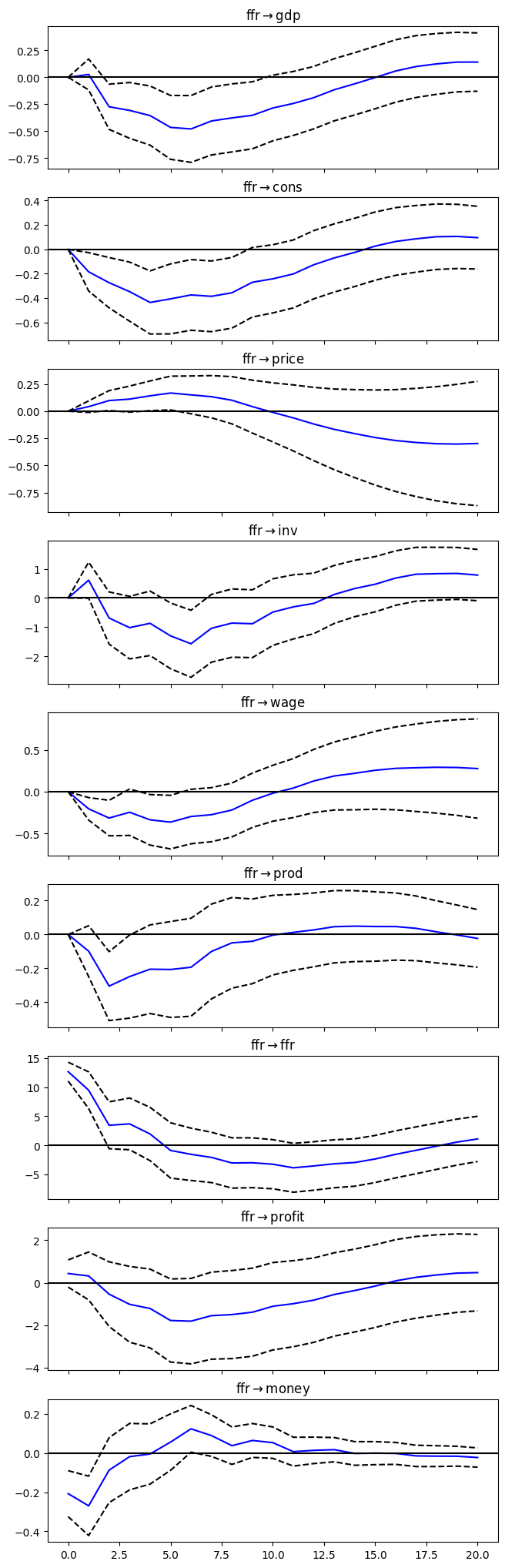

# VAR model

from statsmodels.tsa.api import VAR

# make the VAR model

model = VAR(sample)

# Estimate VAR(4)

results = model.fit(4)

# Assign impulse response functions (IRFs)

irf = results.irf(20)# Plot IRFs

plt = irf.plot(orth=True,impulse='ffr',figsize=(6.5,22.5));

plt.suptitle('');

- Christiano, L. J., Eichenbaum, M., & Evans, C. L. (2005). Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy. Journal of Political Economy, 113(1), 1–45. https://doi.org/10.1086/426038

- Sims, C. A., Stock, J. H., & Watson, M. W. (1990). Inference in linear time series models with some unit roots. Econometrica, 113–144. 10.2307/2938337