MA Model

by Professor Throckmorton

for Time Series Econometrics

W&M ECON 408/PUBP 616

Slides

Wold Representation Theorem¶

Wold representation theorem: any covariance stationary series can be expressed as a linear combination of current and past white noise.

is a white noise process with mean 0 and variance .

, and , which ensures the process is stable.

, a.k.a. an innovation, represents new information that cannot be predicted using past values.

Key aspects¶

Generality: The Wold Representation is a general model that can represent any covariance stationary time series. This is why it is important for forecasting.

Linearity: The representation is a linear function of its innovations or “general linear process”.

Zero Mean: The theorem applies to zero-mean processes, but this is without loss of generality because any covariance stationary series can be expressed in deviations from its mean, .

Innovations: The Wold representation expresses a time series in terms of its current and past shocks/innovations.

Approximation: In practice, because an infinite distributed lag isn’t directly usable, models like moving average (MA), autoregressive (AR), and autoregressive moving average (ARMA) models are used to approximate the Wold representation.

MA Model¶

The moving average (MA) model expresses the current value of a series as a function of current and lagged unobservable shocks (or innovations)

The MA model of order , denoted as MA(), is defined as:

is the mean or intercept of the series.

is a white noise process with mean 0 and variance .

are the parameters of the model.

Key aspects¶

Stationarity: MA models are always stationary.

Approximation: Finite-order MA processes are a natural approximation to the Wold representation, which is MA().

Autocorrelation: The ACF of an MA() model cuts off after lag , i.e., the autocorrelations are zero beyond displacement . This is helpful in identifying a suitable MA model for time series data.

Forecasting: MA models are not forecastable more than steps ahead, apart from the unconditional mean, .

Invertibility: An MA model is invertible if it can be expressed as an autoregressive model with an infinite number of lags.

Unconditional Moments¶

The variance of an MA process depends on the order of the process and the variance of the white noise,

MA(1) Process:

MA() Process:

Autocorrelation Function¶

MA(1) Process:

for

, i.e., any series is perfectly correlated with itself

for

MA() process:

for

for

MA Model as DGP¶

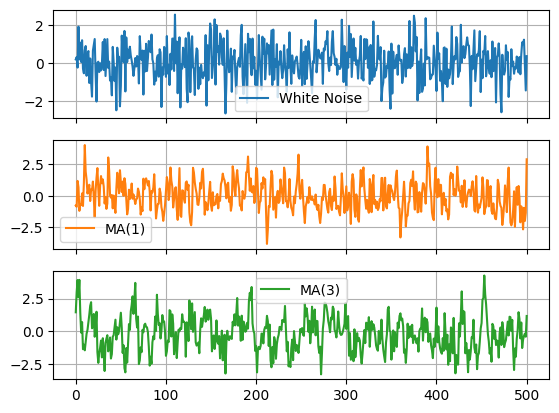

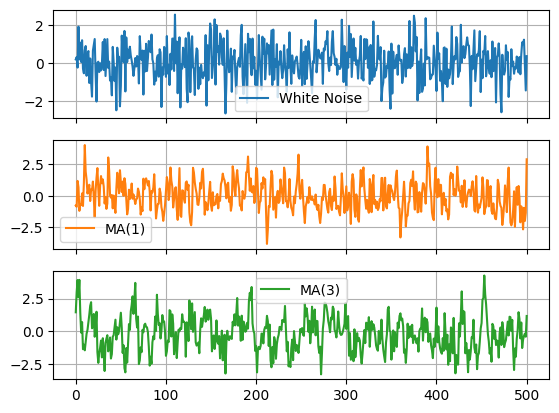

Let’s compare a couple different MA models to their underlying white noise.

White noise:

MA(1):

MA(3):

# Import libraries

# Plotting

import matplotlib.pyplot as plt

# Scientific computing

import numpy as np

# Data analysis

import pandas as pdDIY simulation¶

# Assign parameters

T = 501; mu = 2; theta1 = 0.6; theta2 = 0.5; theta3 = 0.7;

# Draw random numbers

rng = np.random.default_rng(seed=0)

eps = rng.standard_normal(T)

# Simulate time series

y = np.zeros([T,3])

for t in range(3,T):

y[t,0] = mu + eps[t]

y[t,1] = mu + eps[t] + theta1*eps[t-1]

y[t,2] = (mu + eps[t] + theta1*eps[t-1]

+ theta2*eps[t-2] + theta3*eps[t-3])# Convert to DataFrame and plot

df = pd.DataFrame(y)

df.columns = ['White Noise','MA(1)','MA(3)']

df.plot(subplots=True,grid=True)array([<Axes: >, <Axes: >, <Axes: >], dtype=object)

# Plot variables

fig, axs = plt.subplots(len(df.columns),figsize=(6.5,3.5))

for idx, ax in enumerate(axs.flat):

col = df.columns[idx]

y = df[col]

ax.plot(y); ax.set_ylabel(col)

ax.grid(); ax.autoscale(tight=True); ax.label_outer()

print(f'{col}: \

E(y) = {y.mean():.2f}, \

Std(y) = {y.std():.2f}, \

AC(y) = {y.corr(y.shift(1)):.2f}')White Noise: E(y) = 0.06, Std(y) = 0.97, AC(y) = -0.05

MA(1): E(y) = 0.02, Std(y) = 1.18, AC(y) = 0.46

MA(3): E(y) = -0.17, Std(y) = 1.33, AC(y) = 0.57

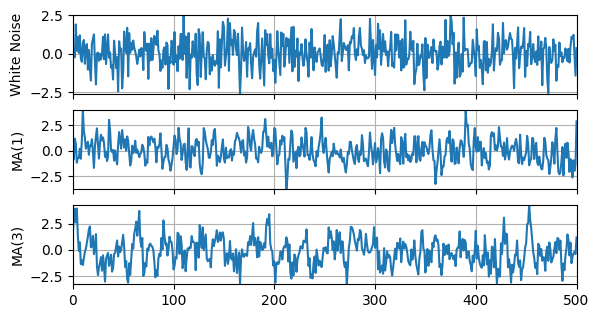

Using statsmodels¶

# ARIMA Process

from statsmodels.tsa.arima_process import ArmaProcess as arma

# Set rng seed

rng = np.random.default_rng(seed=0)

# Create models (coefficients include zero lag)

wn = arma(ma=[1]);

ma1 = arma(ma=[1,theta1])

ma3 = arma(ma=[1,theta1,theta2,theta3])

# Simulate models

y = np.zeros([T,3])

y[:,0] = wn.generate_sample(T)

y[:,1] = ma1.generate_sample(T)

y[:,2] = ma3.generate_sample(T)# Convert to DataFrame

df = pd.DataFrame(y)

df.columns = ['White Noise','MA(1)','MA(3)']

df.plot(subplots=True,grid=True)array([<Axes: >, <Axes: >, <Axes: >], dtype=object)

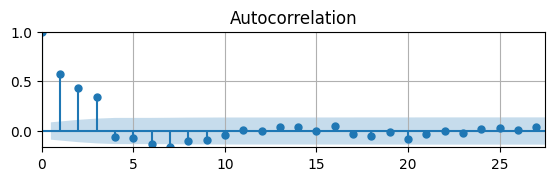

# Auto-correlation function

from statsmodels.graphics.tsaplots import plot_acf as acf

# Plot Autocorrelation Function

fig, ax = plt.subplots(figsize=(6.5,1.5))

acf(df['MA(3)'],ax)

ax.grid(); ax.autoscale(tight=True);

Since the DGDP is an MA(3), the ACF shows the correlations are only significant for the first 3 lags.

Estimating MA Model¶

In an MA model, the current value is expressed as a function of current and lagged unobservable shocks.

However, the error terms are not observed directly and must be inferred from the data and estimated parameters.

This creates a nonlinear relationship between the data and the model’s parameters.

The

statsmodelsmodule has a way to define an MA model and estimate its parameters.The general model is Autoregressive Integrated Moving Average Model, or ARIMA(), of which MA() is a special case.

The argument

order=(p,d,q)specifies the order for the autoregressive, integrated, and moving average components.See statsmodels for more information.

# ARIMA model

from statsmodels.tsa.arima.model import ARIMA

# Define model

mod = ARIMA(df['MA(3)'],order=(0,0,3))

# Estimate model

res = mod.fit()

summary = res.summary()

# Print summary tables

tab0 = summary.tables[0].as_html()

tab1 = summary.tables[1].as_html()

tab2 = summary.tables[2].as_html()

# print(tab0); print(tab1); print(tab2)| Dep. Variable: | MA(3) | No. Observations: | 501 |

|---|---|---|---|

| Model: | ARIMA(0, 0, 3) | Log Likelihood | -700.202 |

| Date: | Wed, 05 Feb 2025 | AIC | 1410.405 |

| Time: | 14:24:16 | BIC | 1431.488 |

| Sample: | 0-501 | HQIC | 1418.677 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.1391 | 0.125 | -1.114 | 0.265 | -0.384 | 0.106 |

| ma.L1 | 0.6199 | 0.033 | 18.713 | 0.000 | 0.555 | 0.685 |

| ma.L2 | 0.5248 | 0.037 | 14.251 | 0.000 | 0.453 | 0.597 |

| ma.L3 | 0.6949 | 0.034 | 20.158 | 0.000 | 0.627 | 0.762 |

| sigma2 | 0.9540 | 0.064 | 14.819 | 0.000 | 0.828 | 1.080 |

| Ljung-Box (L1) (Q): | 0.09 | Jarque-Bera (JB): | 1.32 |

|---|---|---|---|

| Prob(Q): | 0.76 | Prob(JB): | 0.52 |

| Heteroskedasticity (H): | 1.08 | Skew: | 0.08 |

| Prob(H) (two-sided): | 0.61 | Kurtosis: | 2.80 |